2025 Tariffs and considerations for grain markets

The imposition of tariffs early in 2025 could affect commodity markets and producers economically

The current economic policies by the new Trump administration have producers, agribusinesses, and markets talking about the implications that new tariffs and other economic policies will have in 2025 agricultural markets. It is important to understand that policy initiatives remain very fluid and ever-changing, and can have both short-term and long-term effects depending on the final form they take and on future policies enacted. For example, shortly after the tariff announcement on February 1, tariffs were paused for one month for Mexico and Canada but remained in place for China. However, it is imperative to understand the basic economics of the imposition of tariffs and what it could mean for producers in 2025.

On Saturday, Feb. 1, President Trump imposed tariffs on Canada, Mexico, and China through a national emergency order in which a 10% duty was placed on imports from China, and 25% duties on imports from Mexico and Canada. Additionally, on Thursday, February 13, an executive order was signed to consider imposing reciprocal tariffs on numerous trading partners. So, what exactly does all of this mean? First, let’s take an opportunity to refresh ourselves with what tariffs are, the intent of imposing tariffs, and the general economic effect tariffs have on economies.

What exactly is a Tariff?

A tariff is simply a tax by a government on imported goods or services. These taxes are considered “ad-valorem” or based on the value of the product. They are also usually collected by a country’s customs officials at the goods or services place of entry into that country.

Tariffs can also take on many forms, such as retaliatory or reciprocal tariffs. Retaliatory tariffs are tariffs imposed in response to another country’s tariffs, typically to counteract perceived trade restrictions or economic harm. A reciprocal tariff is a tariff set at the same rate as a trading partner’s tariff, often as part of a mutual trade agreement.

Overall, the intent of tariffs is to:

- Protect domestic industries

- Generate additional government revenues

- Discourage imports from other countries to reduce balance of trade deficits within a market

- Discourage domestic consumption of an imported good or service

The following information shows the history of United States Federal Government tax receipts on production and imports from customs duties.

The graph displays the total tax receipts on production and imports which has slowly and steadily increased over time since about 1970 but has experienced greater amounts of volatility from about 2016 to the present. However, when you compare the amount of tariff revenue as a share of total government revenue, what you see in the chart below is that tariff duties are an insignificant source of government revenue accounting for only 1.8% of U.S. government receipts in 2023 at $80 billion.

Economic Effect of Tariffs

Economists will often emphasize that tariffs are largely inefficient in regulating markets and a better strategy is to operate with free trade. Free trade is where world prices are set based upon consumers being able to purchase products from any market and suppliers can sell to any market without governments setting taxes on those products. The open exchange between consumers and suppliers allows both parties to achieve an equilibrium price for goods sold. For example, if a country is short on domestic supply or is not able to produce them, consumers of that good may be able to meet their needs with import markets, which assists in setting the world price.

A consequence of using tariffs is that they may limit free trade by artificially raising prices above what is being offered by a supplying country. Limiting free trade can also potentially damage trade relationships with other countries on which the tariff has been imposed. Damage to trade relationships not only involves less active trade between countries but could even lead to a trade war where retaliatory tariffs are imposed, leading to a worse outcome overall for consumers in both countries.

Generally, the effect of tariffs on domestic consumers is that they will end up paying a higher price, purchasing less of a product, or both. In some cases, a larger country (like the U.S.) has what’s called oligopsony power, where the nation has a large enough share of the world market for a particular good or service where they can have influence and effect the world price unilaterally. A country with oligopsony power can lower world market prices by imposing tariffs. For example, let’s say the U.S. imposes a tariff on a good or service like fertilizer. The U.S. ranks third in the world for fertilizer imports and has oligopsony power in the world market. If the U.S. imposes a tariff on fertilizer, there will be less domestic demand from the U.S. for fertilizer as producers will limit purchases to bare minimum levels. If enough exporting countries depend on the U.S. purchasing fertilizer, they will attempt to maintain sales to the U.S. consumers by lowering prices, which lowers the world price as well.

Tariff Intentions: The Politics of Trade

Recent history would indicate that tariffs are:

- Largely considered inefficient and distortionary by many economists (inhibits free market activity)

- Positively correlated with higher raw material prices (domestic consumers pay more)

- Greater risks for trade wars (retaliation by other countries)

Then what would be the goal of imposing tariffs on other nations at all? One reason is that tariffs can also be used as a political tool. Tariffs can impose or leverage a set of political policies or bargaining points for negotiating abroad with other countries. In simple terms, tariffs can be used to enforce a behavior or political change by one country towards another.

The difficulty with using tariffs in this example is that the economic burden often rests with consumers until political situations are resolved, which could last as little as a few weeks to as long as several years. Additionally, if retaliatory tariffs go into effect, producers would be affected as their products are now subject to a tariff in the export market.

The Effect on Agriculture Producers

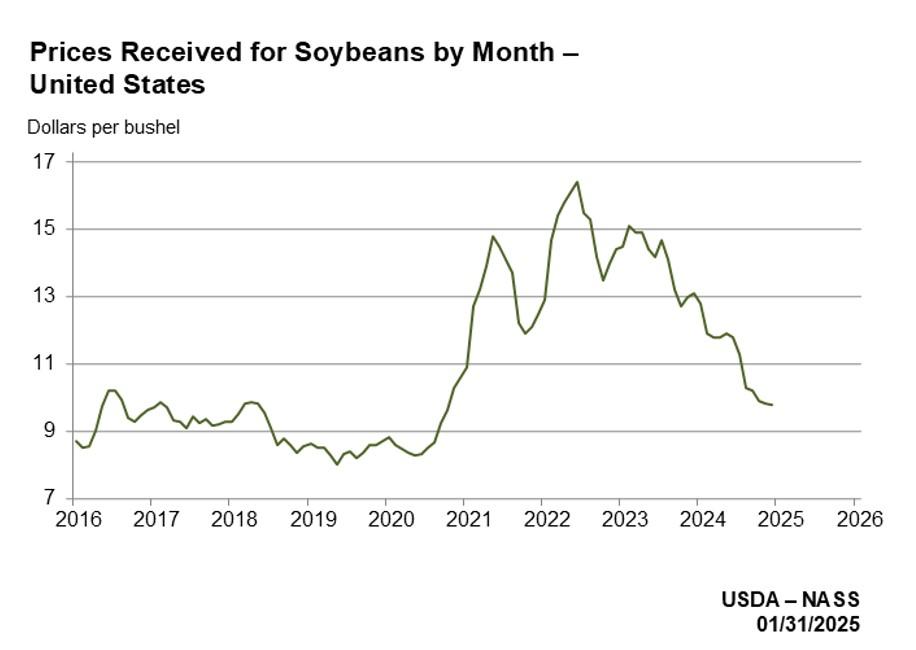

The bottom line is that if there is a long-term policy of tariff use, it will affect commodity-based agricultural producers in the United States. We saw a similar policy and result in 2018 when tariffs were imposed by the United States on China. China was a principal buyer of U.S. soybean exports when tariffs were imposed on Chinese goods. This resulted in China imposing retaliatory tariffs on US soybeans and other products. China then navigated the marketplace to seek alternative supplies of soybeans; mainly from Brazil and Argentina. During this period, U.S. agricultural exports to China plummeted, with losses exceeding $25 billion. These types of losses led to The National Corn Growers Association (NCGA) and American Soybean Association (ASA) releasing a trade study in 2024 that outlines: How Potential New Tariffs Could Impact U.S. Soybeans and Corn. David Ortega, a professor at Michigan State University also addressed these concerns in an article for Newsweek: American Agriculture Can't Afford Another Trade War with China.

Exports aren’t the only area of concern as the U.S. is also a major agricultural importer. Tariffs don’t just increase the price of consumer goods but also raise the cost of intermediary goods and inputs that go into agricultural and food production (fertilizer, equipment, ingredients, etc). For example in 2023 the US became a net agricultural importer: https://www.ers.usda.gov/data-products/ag-and-food-statistics-charting-the-essentials/agricultural-trade

Looking forward to 2025, U.S. producers now face growing levels of uncertainty and volatility given the new policies of the current U.S. administration. This comes at a time where just in the past few years, domestic agriculture producers have battled a multitude of challenges that have affected farm profitability.

The first of these challenges was extremely high input prices in 2021-2023 on products like nitrogen and diesel fuel. Russia is a leading exporter of phosphorus and potassium fertilizers and the number one exporter of nitrogen. High input prices were largely caused by supply chain issues, transportation challenges, and sanctions related to the Russian/Ukrainian conflict. This prevented agricultural inputs from Russian exports from being received by U.S. producers largely. In August of 2021, fertilizer prices were up 25% from March 2021, following the invasion of Ukraine by Russia, and again those fertilizer prices rose over 50% from February 2022 to April 2022.

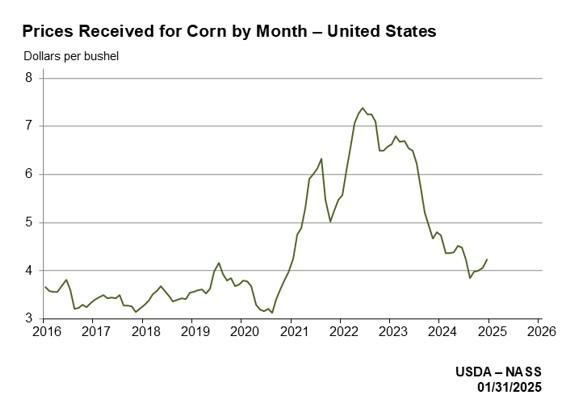

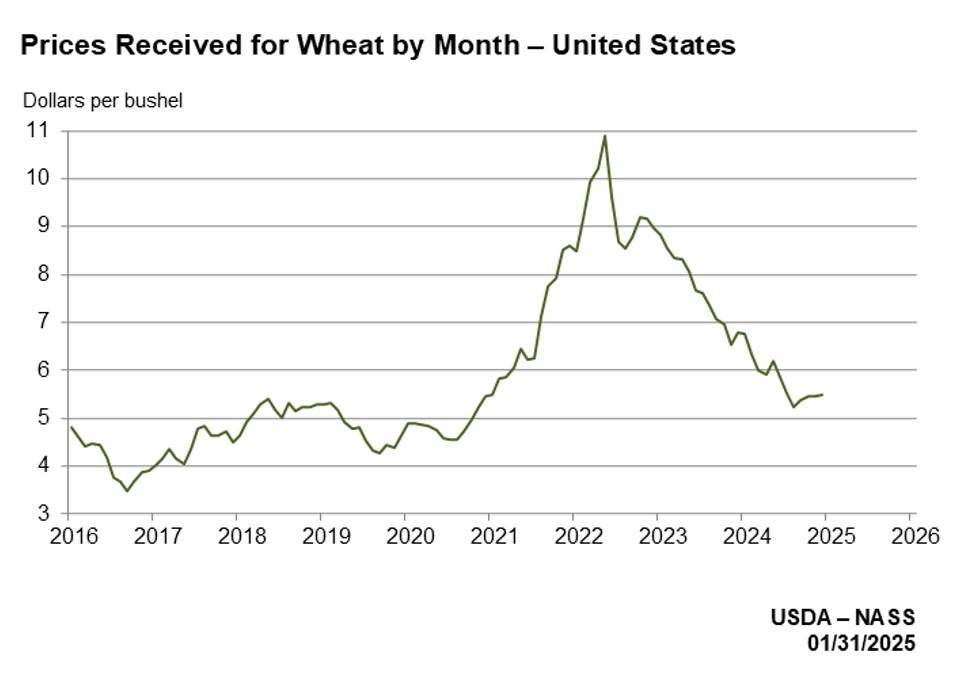

In addition to high input prices, producers have seen major grain market revenue decline in terms of prices received for commodities. Producers are not receiving premium prices for commodities like they did in 2022 – 2023. The higher prices received for commodities like corn in these years helped balance out the increased input costs mentioned previously. However, commodity spot prices in 2024 markets were significantly lower than in previous years while at the same time, input prices and other costs remained elevated when compared to pre-2021 costs of production.

Putting it All Together: Closing Implications

The United States is a leading exporter and importer of agricultural products in the world. In many cases, goods can move multiple times across country borders. Especially with closer neighbors, like Canada, where goods are traded frequently.

The U.S. agricultural output has grown faster than domestic demand for many products over the past 25 years, reaching $174 billion in 2023, up from $57.3 billion in 1998. As a result, U.S. producers have historically relied on export markets to sustain revenues in recent decades.

U.S. agricultural exports have also shifted over the last 25 years as well. Most recently, agreements like the North American Free Trade Agreement (NAFTA) and United States-Mexico-Canada agreement (USMCA) have removed trade barriers causing exports to Canada and Mexico to quadruple in a short amount of time. China’s share of U.S. agricultural exports also rose sharply during 2012-2023.

Tariffs and any ensuing trade war with principal importers of U.S. agricultural commodities would have drastic effects on U.S. producers. This is especially true with China, which has already imposed retaliatory tariffs on U.S. products including agriculture and other industrial products. If tariffs are expanded to include commodity products, American producers would see a drop in commodity prices that would further constrain domestic farm revenues. The reduction in trade and exports with countries like China would lead to export losses that could be in the billions of lost value. Additionally, this would cause major importers of U.S. agriculture products to source agricultural imports elsewhere, allowing competing countries to further gain market share of these products. According to the NCGA and ASA trade study, countries like Brazil and Argentina would be rewarded in the case of retaliatory corn and soybean tariffs, as they would be further incentivized to expand production to achieve a higher share of the global commodity markets.

Finally, a larger concern is for long-term implications of tariff use. If free trade remains restricted, the U.S. could lose favorable standing with trading partners as relationships gained over decades of free trade are damaged, leading to an overall loss of production value of U.S farmers. A loss of production value would further test an already constrained U.S farm economy which has battled high input costs and low commodity prices in recent years all while recovering from pandemic-era challenges and the 2018 trade war.

A Final Note – A Recommendation to Producers

The use and frequency of tariffs are expected to increase broadly across many trade markets, even beyond agriculture. As producers look to the 2025 growing season, is it encouraged that they stay in routine contact with input suppliers, marketing brokers or originators, material suppliers, etc. Keeping up-to-date on the latest impacts on costs and prices will be a critical factor in maintaining opportunities for farm profits throughout the year. Producers should focus on keeping their operations efficient, looking for additional ways to decrease input costs to focus on maximizing their profit. It’s important to remember that commodity farmers are often “price takers” not “price makers,” in that you have limited influence in setting market prices. Therefore, because we are unable to control the market prices of our commodities, we should instead focus on any way to decrease production costs and reduce exposure to production risks which will assist you in navigating any volatility with tariffs.

Acknowledgments: Jaime Luke, David Ortega, and Molly Sears of the Department of Agricultural, Food, and Resource Economics at Michigan State University contributed to the content of this article.

This work is supported by the Crop Protection and Pest Management Program [grant no 2024-70006-43569] from the USDA National Institute of Food and Agriculture. Any opinions, findings, conclusions, or recommendations expressed in this publication are those of the author(s) and do not necessarily reflect the view of the U.S. Department of Agriculture.

Print

Print Email

Email