Comparison tool for JBS high-energy Holstein contracts

Comparison tool for JBS high-energy Holstein contracts.

JBS, one of the major beef packing companies in the U.S., recently announced that they will be offering a new high-energy Holstein/Holstein-cross contract option for cattle feeders that raise and market Holstein cattle. Many producers have had questions on deciding which contract they should be using to optimize their income when they market their cattle with JBS. In response to the questions received from cattle producers, this article will discuss some of the contract differences and introduce a Contract Decision Tool that producers can use to compare loads of cattle marketed with the old and new contracts.

Currently, JBS is offering producers the option of choosing to use either the old or new high-energy Holstein contract as a means of marketing their fed Holstein cattle. The value of cattle being marketed to JBS is assigned a contract price that applies premiums and discounts based on the United States Department of Agriculture (USDA) quality grade, USDA yield grade, hot carcass weight, carcass maturity, and muscling score of the cattle. Changes to the Chicago Mercantile Exchange (CME) live cattle futures, basis, as well as the premium and discount price for each carcass characteristic, between the old and new contracts impacts the total income received.

The old contract discounts hot carcass weight $15/cwt if less than 700 pounds or greater than 1,000 pounds. Hot carcass weight discounts increase to a greater extent as carcass weights deviate further from 700 to 999 pounds with the new contract. Changes to hot carcass weight premium and discount prices between the old and new contracts indicate JBS’ desire for cattle that are uniform in size to meet the product specifications of their food service customers.

For quality grade adjustments on the old contract, a premium is offered for having greater than 70% of the cattle grading USDA Choice or Prime. Discounts are assigned if less than 70% of the cattle graded USDA Choice or Prime at the weekly Choice/Select spread price. Cattle receiving a USDA Standard grade, “No roll” (no grade assigned), or dark cutter designation are considered ‘out’ of the current contract price and priced with the current cash market price.

With the new contract, $10/cwt premiums will be assigned to USDA Prime carcasses, but cattle grading USDA Select will receive a discount price at the Choice/Select spread price plus $4/cwt. Standard grades, “No rolls”, and dark cutters will be assigned larger discount prices with the new contract. Changes to quality grade prices signal the demand for higher quality beef by JBS. The discount value received for cattle grading USDA Select will be greater on the new contract and the USDA Select discount price on the new contract can fluctuate with the weekly Choice/Select spread price depending on the time of year. Expect greater discounts for contracted cattle grading USDA Select during late spring (May and June) and fall (November) because this is typically when the weekly Choice/Select spread price is greatest. When using the Contract Comparison Tool, consider the expected weekly Choice/Select spread price for the delivery month of your cattle by checking out the 5-year average for the weekly Choice/Select spread price.

A discount for yield grade 4 cattle is assigned when the load of cattle includes more than 5% yield grade 4 cattle with the old contract. The 5% leeway is no longer the case for the new contract, so the number of cattle with a yield grade of 4 will contribute a greater loss in value on the new contract compared with the old contract. However, the discount price for yield grade 5 cattle is less with the new contract compared with the old contract. Discounts applied to cattle over 30 months of age are similar between the old and new contracts. The new contract will discount cattle lacking muscle and receiving muscle scores 3 and 4, while the old contract did not discount for muscle score.

While the changes to discount prices for the new contract may sound less favorable, the new contract basis is -$8/cwt from the CME live cattle futures price compared with -$12/cwt on the old contract. Additionally, the dressing percentage used to calculate the contracted carcass/dressed price is 61.5% for the new contract compared with 61% for the old contract. This means that cattle will have a greater initial value on the new contract compared with the old contract before discounts and premiums are applied to the value for the total load of cattle.

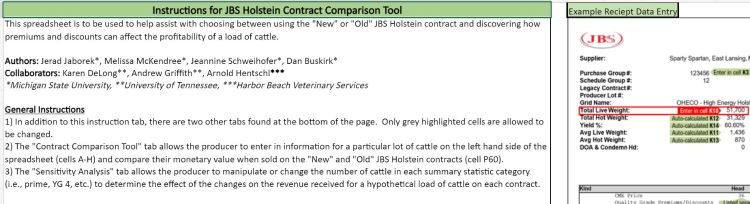

If you are interested in determining the value of your cattle on the new contract from previous receipts, try the Contract Comparison Tool. The Contract Comparison Tool includes an instructions tab with an example JBS receipt to help guide you through data entry. There is a Contract Comparison Tool tab where you will input your own data or numbers from past JBS receipts and a Sensitivity Analysis tab to create hypothetical scenarios to determine their effects on the income received. If you have any questions or need any assistance learning how to use the Contract Comparison Tool, feel free to contact Jerad Jaborek, Michigan State University Extension feedlot systems educator.

Print

Print Email

Email