How land patents relate to planning, zoning and property taxes

Virtually all land has been land patented and that property is subject to property tax and zoning regulation.

From time-to-time individuals will make the claim, or argue, that they do not have to pay property tax, are not subject to planning and do not have to get a zoning permit. This is because, they claim their land was patented directly from the U.S. Government.

The short answer is the arguments of this genre are nonsense.

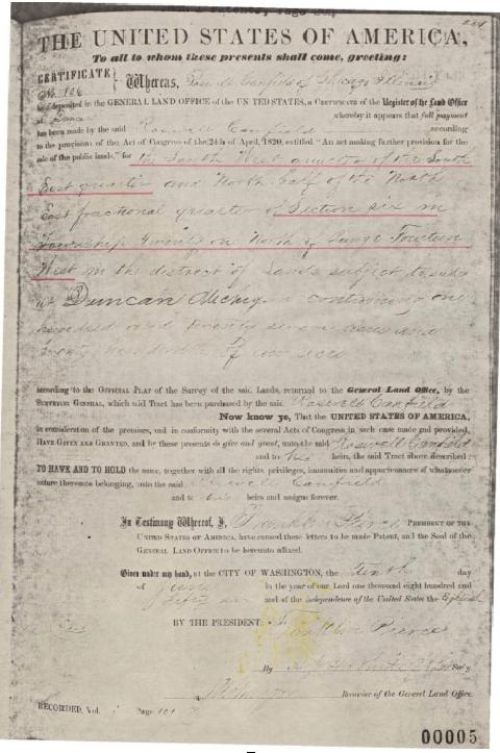

What is a land patent?

The U.S. Government acquired land in Michigan by winning the war of 1812, and the peace treaties from that war, and from various treaties with Native American nations. As the state was settled, the U.S. had the entire state surveyed. This was done by the Government Land Office (GLO). Thus those surveys are known as the GLO survey.

This process divided the state into six-by-six mile townships and divided each township into 36 square mile sections. The GLO survey placed a corner monument at each section corner, the midpoint between section corners and at other locations. When land was sold by the U.S. Government to someone, which involved creating the first deed for that land, it was called a “patent.” That is what a “Land Patent” is.

Nearly all land in Michigan was initially conveyed by land patent. Some of the notable exceptions are where there were French claims in Monroe County, Detroit, Cheboygan County, Sault Ste Marie, and Mackinaw Island. In those instances, the land was conveyed by the French (or Canadian) Government which was carried over when Michigan became part of the U.S.

Thus nearly all land was land patented, and the claims about not being subject to tax, zoning, etc. would apply nearly everywhere.

Are land patents subject to property tax?

The best summary of law concerning taxation of land which was patented is found in Michigan Attorney General Opinion #6810. That opinion reviews the various court cases in the U.S. which indicate property that was patented are subject to property tax just like land which was not patented. The Attorney General Opinion reads:

‘You have asked if the State of Michigan may assess and tax privately owned lands in the State of Michigan that were initially conveyed by patent from the U.S. Government.

‘Const 1963, art 9, Sec. 3, provides, concerning the taxation of property by the state, in part:

“The legislature shall provide for the uniform general ad valorem taxation of real and tangible personal property not exempt by law.”

‘Section 1 of 1893 PA 206, the General Property Tax Act, MCL 211.1 et seq.; MSA 7.1 et seq., provides:

“That all property, real and personal, within the jurisdiction of this state, not expressly exempted, shall be subject to taxation.”

‘The only exemption even arguably applicable to the situation posed in your request is that set forth in section 7 of the General Property Tax Act, which provides:

“Public property belonging to the U.S. is exempt from taxation under this act. This exemption shall not apply if taxation of the property is specifically authorized by federal legislative action or federal administrative rule, regulation, or lease.”

‘The foregoing provision recognizes the primacy of the U.S. Government, under U.S. Const, art IV, Sec. 3, cl 2, over property to which it has title. However, nothing in that provision governs the regulation or taxation of property after it no longer belongs to the U.S. - i.e., after its conveyance to others.

‘That conveyance by patent divests title from the U.S. is well established. In Brewer v Kidd, 23 Mich 440 (1871), the Michigan Supreme Court considered when title to land belonging to the U.S. became divested in a suit to enjoin the public sale of land claimed to have already been purchased by the plaintiff. The Court noted that inasmuch as no patent had yet issued, jurisdiction over the property was solely that of the U.S. Government under U.S. Const, art IV, Sec. 3, cl 2, but that once transferred by patent, jurisdiction became vested in the state:

“Under these provisions, the power of sale and disposition of the public lands, and of prescribing the rules, regulations, officers, agencies and the whole course of proceedings, for effecting such sales is vested exclusively in the federal government, until the sale is consummated by the issuing of a patent to the purchaser, which alone (in ordinary cases like the present, at least) divests the title of the U.S. and vests it in the purchaser, when, for the first time, it becomes in all respects subject to the local laws of the state, like the great mass of other property within its limits.”

– 23 Mich 443-444.

‘The foregoing conclusion accords with that of the U.S. Supreme Court in Stryker v Goodnow, 123 US 527; 8 S Ct 203; 31 L Ed 194 (1887). There, the Court addressed and rejected assertions by certain parties that lands sold by the U.S. were not taxable by the State of Iowa within a year after title passed from the U.S. As the Stryker Court noted:

“Whether the lands were taxable within a year after the title passed out of the U.S. is not a Federal question. There was nothing in the act of Congress admitting Iowa into the Union, or in any other act of Congress to which our attention has been directed, which in any manner interfered with the power of the State to tax lands as soon as they ceased to be the property of the U.S. The only prohibition was against taxation whilst the U.S. were the owners.”

– 123 US 535-536.

‘It is my opinion, therefore, that the State of Michigan may assess and tax privately owned lands in the State of Michigan that were initially conveyed by patent from the U.S. Government.’

– Frank J. Kelly, Michigan Attorney General, July 6, 1994.

Are patent lands subject to planning and zoning and other ordinances and laws?

In Brewer v Kidd, 23 Mich 440 (1871), the Michigan Supreme Court citing U.S. Constitution, Article IV, Section. 3, cl 2, said that once transferred by patent, jurisdiction became vested in the state:

“Under these provisions, the power of sale and disposition of the public lands, and of prescribing the rules, regulations, officers, agencies and the whole course of proceedings, for effecting such sales is vested exclusively in the federal government, until the sale is consummated by the issuing of a patent to the purchaser, which alone (in ordinary cases like the present, at least) divests the title of the U.S. and vests it in the purchaser, when, for the first time, it becomes in all respects subject to the local laws of the state, like the great mass of other property within its limits.”

– Emphasis added. 23 Mich 443-444.

In Hynes v. Charter Towship of Waterford (166 F.3d 1214 (6th Cir. 1998)) the Sixth Circuit U.S. Court of Appeals ruled “In general, a state may regulate privately-owned lands whose title derives from federal patents. . . . Moreover, a long line of cases indicates, in dicta, that states may regulate such land after title passes to a private landowner. See, e.g.,Wilson v. Omaha Indian Tribe, 442 U.S. 653, 669-71, 99 S.Ct. 2529, 61 L.Ed.2d 153 (1979); Oneida Indian Nation v. County of Oneida, 414 U.S. 661, 677, 94 S.Ct. 772, 39 L.Ed.2d 73 (1974); People v. Kidd, 23 Mich. 439, 443-44 (1871).”

The court further said “The [land] use restrictions are valid, incidental regulations, and do not amount to an assertion of a public trust. Michigan and Waterford apply their restrictions broadly and neutrally, and do not single out any particular land parcel. Moreover, the restrictions do not impair Hynes' usage anywhere close to the extent of the restrictions . . .”

In the court case Groninger v. Department of Envtl. Quality (Unpublished No. 318380, January 29, 2015) the Michigan Court of Appeals heard a case about federal patents, among other things. In that case about Groningers’ land where the chain of title goes back to a federal patent granted in 1855. The Michigan Department of Environmental Quality (DEQ) was prevented from entering the property, “apparently to inspect a driveway that was being built, it sought a warrant to conduct a wetlands inspection.”

Groningers argued that the federal patent removed the property from the DEQ’s authority, and that any regulation of their land impairs their patent, which violates the U.S. and Michigan Constitutions. The court noted that the definition of a “wetland” in the WPA [Michigan Wetlands Protection Act MCL 324.30301 et seq.,] “makes clear that the statute applies to any ‘land’ bearing certain characteristics of water or aquatic life.

There is no limitation on the types of land affected by the WPA, nor is there any distinction made between private, public, or federal lands.” The court concluded that the broad definitions in the WPA evidence “the intent for the WPA to apply to any land under the authority of the executive department, which would be any land in Michigan, whether it is federal, state, public, or private land.”

Those in Michigan State University Extension that focus on land use provide various training programs on planning and zoning, which are available to be presented in your county. Contact your local land use educator for more information.

Print

Print Email

Email