Lessons learned from the 2019 season part 4

This article focuses on crop insurance as a marketing tool.

As planting windows narrowed this past spring, the ability to cover a farm’s cost of production became a central concern. Cash flow projections compared whether to raise a crop or take preventative planting options through insurance. The main worry on most farms was whether they could produce enough crop at the market prices offered to meet their financial needs. There was a significant amount of hesitation and unease about whether it was safe to take out even a single contract.

As we look to better prepare ourselves for the future, we have to keep in mind that marketing is all about confidence. Confidence that the price on the futures board will cover the farm’s costs and return a profit for the farm as well as confidence that the yield will be there to ensure contracts can be met. Understanding what the cost of production and break-evens helps us to feel confident about the market price. We feel secure in our knowledge that the price with the right yield will cover our financial responsibilities. But what about that same confidence in yield?

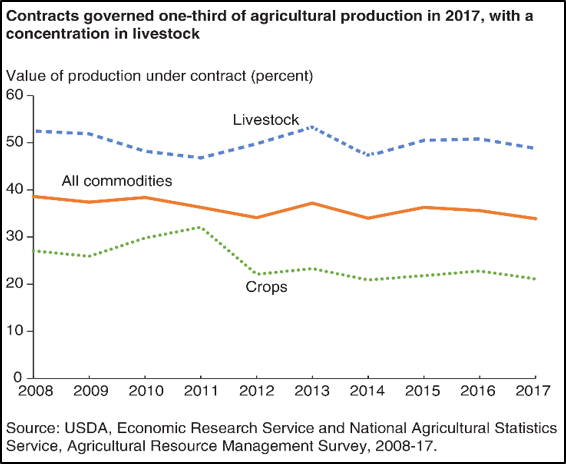

The USDA’s Economic Research Service reports only 21% of the crop production grown in 2017 was sold under contract. Corn was contracted at approximately 12%, while soybeans were a bit better at 18%. According to the report, those values have hardly changed over the last 20 years. One reason that producers have not taken out more contracts is a lack in confidence in the yield they’ll have in order to fill those obligations.

The USDA’s Economic Research Service reports only 21% of the crop production grown in 2017 was sold under contract. Corn was contracted at approximately 12%, while soybeans were a bit better at 18%. According to the report, those values have hardly changed over the last 20 years. One reason that producers have not taken out more contracts is a lack in confidence in the yield they’ll have in order to fill those obligations.

What has changed over the course of the last two decades? More producers have been taking out crop insurance policies that include a tool that can help decide how much grain to safely contract. In fact, as of December 31st, 2019, the USDA’s Risk Management Agency reports that over 69% of producers with crop insurance use this policy. They simply don’t utilize it to its fullest potential.

This policy is called Revenue protection

Revenue protection has been around for a few decades. It operates by protecting yield and price concerns. Prices are set using the future’s market and yield which is based on a percentage of the farm’s historical production. This is the component about the policy that is relatively well known as producers think of the insurance it provides. However, how does this same policy help decide how much grain to contract? How can we use it to feel more secure and confident in our production numbers?

Let’s look at an example farm that raises 600 acres of soybeans and has an actual production history (APH) of 40 bushels per acre. They’ve taken out a 75% policy with their revenue protection. That means they are insured for 18,000 bushels.

| Revenue Protection Example | |

| Soybeans Acres | 600 acres |

| APH Yield | 40 bushels |

| Revenue Coverage | 75% |

| 600 x 40 x 75% = | 18,000 bushels |

The farm historically has been able to raise 40 bushels of soybeans per acre and should feel confident in its ability to raise 75% of its average production, or 18,000 bushels. The farm should feel reassured in its ability to take out market contracts for the same number of bushels.

However, what about years where we experience a weather event that reduces yields below what we need to meet contracts? What if prices also go up because of that event and the soybeans we need to buy are more expensive? The revenue protection policy has that covered.

Prior to harvest, the example farm contracted the 18,000 bushels for $9.54, but only was able to produce 13,200. That’s 4,800 bushels that will need to be purchased to fill the contract and market price that has risen to $11.00 per bushel.

Producers with this insurance will remember that their policy considers the harvest price and will adjust the revenue guarantee if that future’s price is higher. The indemnity payment that is received in this example is $54,000 and can be used toward the purchase of the bushels needed to fill the outstanding market contracts.

| What if there's no yield and prices go up? | |

| Pre-harvest market of 18,000 bushels at $9.54 | $171,720 |

| Purchase 4,800 bushels at $11.00 | - $52,800 |

| Crop Insurance Indemnity Payment 4,800 bushels at $11.25 (future price) | + $54,000 |

| Gross return to the farm | $172,920 |

This illustrates how a farm can use its crop insurance to determine the bushels available to market and secure its ability to fulfill their contracts. By understanding and using tools like these, we can provide a means to lock-in farm revenues and secure our best opportunity for a successful season.

To find out more information and get a complete copy of the article series, you can visit here at the MSU Extension Farm Management Resources page.

Print

Print Email

Email