Many members can be involved in a 4-H club’s financial business

With some forethought, 4-H leaders can design their club so that numerous members have the invaluable experience of handling various aspects of the club’s finances.

Michigan 4-H Youth Development allows and encourages 4-H clubs to raise funds for educational purposes. With some forethought, 4-H leaders can design their club so that numerous members have the invaluable experience of handling the club’s financial business. Here are some examples.

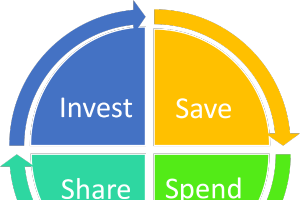

- Establish a club budget at the beginning of the year. Allow all the members to grapple with the challenges of determining how much money they think they need for the 4-H programming year (Sept. 1 – Aug. 31) and how they will secure those funds. Adjustments may be necessary over the course of the year; that is acceptable and helps youth understand that budgets are our “best guess.” The exercise also helps them hone the very useful life skill of preparing a budget.

- Elect a club treasurer who handles all the money going in and out of the club including paying bills for the group. The extent of adult oversight should depend on the age and experience of the youth treasurer.

- In a large club, accepting and tracking 4-H participation fees could be the responsibility of the club’s assistant treasurer.

- A treasurer’s report should be given at each meeting so the members know what income and expenses happened during the previous month. The report should be delivered in such a way that the members understand the financial activity of the club; this understanding will be helpful when they prepare next year’s budget.

- Establish an account at a local bank or credit union so the youth learn how to deposit and withdraw money, how to read a statement, etc. If your group has more than $100, it is a requirement to have an account at a bank or credit union.

- Openly discuss with the members how to properly acknowledge donations. Let the members decide how to best do that and which of them will take the lead on that important task.

- Involve members in keeping the club’s inventory of items purchased with club funds. Be sure they understand that since 4-H money was used to purchase the items, any non-consumables must be turned over to the 4-H office if the club disbands.

- Older 4-H members should assist leaders in conducting an annual club audit and the Annual Financial Summary Report.

- 4-H fundraising activities should be educational. In addition to the members handling money during the fundraiser, members should be involved in preparing the request to the 4-H office for permission to conduct a fundraiser as well as completing the follow-up report.

All of these practices help the members realize that handling money is a skill that can be learned through experience. It also sends the clear message that keeping everyone informed and having an “open book” attitude about the club treasury is the best way to protect individual members’ reputations and the club’s funds.

These valuable practices and more are outlined in the “Financial Manual for 4-H Volunteers: Leading the Way to Financial Accountability” and the “Financial Manual for 4-H Treasurer: A Guide to Managing Money Wisely.”

Michigan State University Extension and Michigan 4-H Youth Development help to prepare young people for successful futures. As a result of career exploration and workforce preparation activities, thousands of Michigan youth are better equipped to make important decisions about their professional future, ready to contribute to the workforce and able to take fiscal responsibility in their personal lives.

Print

Print Email

Email