Who is substituting milk with plant-based beverages and why?

In a recent study published in the Journal of Dairy Science, we surveyed 995 U.S. households to understand whether Americans are consuming milk, plant-based alternative beverages or both.

What is going on with dairy demand, and what is to blame? In a recent study published in the Journal of Dairy Science, we surveyed 995 U.S. households to understand whether Americans are consuming milk, plant-based alternative beverages or both.

While there is a long history of dairy milk as a food staple, fluid milk sales revenue in the United States decreased from nearly $19 billion in 2013 to less than $16 billion in 2018. The downward trend has been attributed to declining milk consumption frequency rather than changing serving portions; Americans born in the 1990’s consume milk less often than earlier generations. This trend is particularly concerning for industry growth as younger generations replace older ones, the average level of fluid milk consumption may continue to decline.

A portion of the decline in beverage milk consumption has been attributed to consumers substituting plant-based alternative beverages made from soybeans, almonds, and other nut and grain crops for traditional dairy milk. Indeed, the sale of non-dairy alternatives has grown by 61% since 2013, and retail sales reached $2.3 billion in 2018.

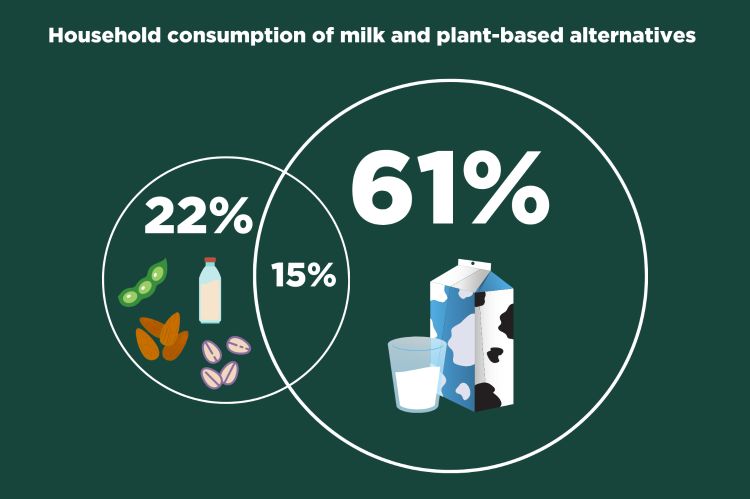

In our analysis of dairy market segments, traditional “Dairy Households” comprised 61.6% of the respondent sample. This cluster of respondent households consumed dairy milk—primarily 2% and whole milk—on a somewhat regular basis and had limited to no consumption of other milks and plant-based beverages. Most Dairy Households were not open to substituting plant-based alternatives for dairy milk in any use. The most likely substitution for Dairy Household consumers were in a smoothie and as a cooking ingredient but even those uses were unlikely.

The second cluster, “Flexitarian Households,” comprised 15.6% of the respondent households. Flexitarians consumed all types of dairy and plant-based milk. The median flexitarian consumed 2% and 1% dairy milk the most, but also consumed all types of the beverages examined with at least some regularity.

The third cluster, “Plant-based Households,” comprised 22.8% of respondent households. Plant-based households frequently consumed almond milk and little else. The Plant-based Household consumption cluster was almost exclusively almond beverage drinkers. Almond milk is the most popular plant-based milk-substitute beverage but recently has been criticized for water-use and lack of nutrients. It is possible that consumers seeking to primarily drink plant-based beverages may change types as different factors and perceptions related to nutrition and environmental impact come to light.

These market clusters suggest that more than three-quarters of the respondent households consumed dairy milk with at least some regularity. While beverage milk consumption has been to a degree substituted for plant-based alternatives, many plant-based drinkers have not entirely shifted their consumption behavior away from dairy milk.

The study also revealed interesting elements about the clusters themselves. For example, respondents from the Dairy Household market segment were older than the Flexitarian and Plant-based Household segments. Flexitarian Household respondents had more formal education than plant-based consumers who, in turn, had more formal education than Dairy Household segment although the absolute mean difference was small.

Additionally, Flexitarian Households were larger than dairy consuming households but statistically equivalent to the households of the Plant-based segment. Flexitarian Households were the most likely to have children under 12 while plant and Dairy Households were equally likely to have younger children. Although the survey did not inquire about lactose or other dairy allergies, it is entirely possible that the presence of children increases the likelihood that those issues play a role in household milk consumption choices. One last interesting aspect of all three consumption clusters was that none were open to substituting a plant-based alternative for their pets.

The silver lining for the dairy industry is that about three-quarters of households are still regularly consumed dairy milk even though about 38% consumed plant-based beverages with 16% consuming both plant-based and dairy alternatives.

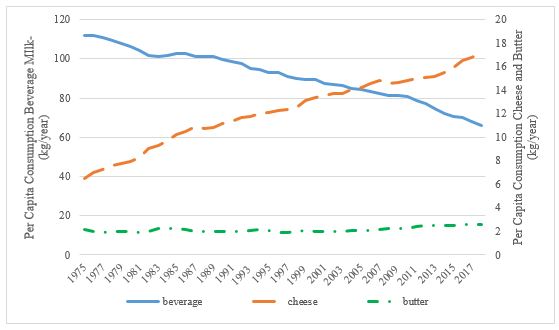

Moreover, although the study focused on fluid milk and plant-based alternatives, it also does not tell the whole dairy story. Although beverage milk consumption per capita has been declining, total dairy product consumption per capita has been growing as other products including cheese, butter and yogurt have grown. In fact, since 2000, total U.S. per capita dairy product consumption increased 25.5%.

In contrast to beverage consumption, cheese consumption per capita increased consistently from 1975 to 2018. Cheese consumption per capita increased 34% from 2000 to 2018 and 20.6% from 2010 to 2018. This increase was across all types of cheese and reflected changing patterns of consumption away from home particularly on pizza. Although the per capita consumption of butter spent the first 25 years of the same period fluctuating, butter consumption per capita increased 23% from 1975 to 2018. Recent years have witnessed a reversal of the health views of butterfat, contributing to a per capita consumption increase of 18% since 2010.

To conclude, while it is true that Americans are drinking less milk, total dairy product consumption has increased through growth in sales of cheese, yogurt, butter, and other dairy product demand, and our recent study suggests that three-fourths of all households are still consuming milk regularly.

Print

Print Email

Email