Soybean trade lessons: Nobody wins in a headbutt

Aug. 6, 2019

The on-going trade negotiations between China and the United States have brought to light the economic and political importance of soybeans -- as well as a flashback to past trade wars and an uncomfortable link to professional boxing.

In response to U.S. tariffs on Chinese goods, China's President Xi Jinping placed a 25% tariff on U.S. soybeans. The tariff artificially raised the price of U.S. soybeans – putting them at 700 yuan and handing Chinese buyers the incentive to buy soybeans from competitors like Brazil, who is selling at 400 yuan/ton. This tactic hit the Midwest hard and resulted in a 49% decrease in soybean exports to China.

According to a state-run press organization, the Chinese government has proposed both short and long-term strategies to avoid reliance on U.S. soybeans. Domestically, the Chinese government is encouraging production through farmer subsidies, which have increased soybean production by 1.1 million MT. That’s an impressive 6.7% increase, especially given the strong competition over land use in China. More soybean production in China likely will come at the expense of producing other crop, or of conservation .

China plans to fill the void left by affordable U.S. soybeans by buying from Argentina, Brazil, Russia and Ukraine. These and other countries have been happy to increase production for and exports to China. However, in the short-term, it is unlikely that China can tap other sources for all of the soybeans needed to replace the United States’ former contribution. Some U.S. soybeans will continue to go to China. The question is will they get there directly or by moving through other countries with unrestricted access to the Chinese market.

There is evidence to believe U.S. soybeans will pass through another country. We need only to look at Paraguay. Recent work from our research team highlights Paraguay’s unique position as a top soybeans producer that does not export ANY soybeans to China due to geo-political relations. In the recent publication, we show that Paraguay has responded to China’s demand by increasing soybean exports to countries that are also top soybeans exporters, namely Brazil, Argentina, Uruguay, Russia and Ukraine. Since last year, Paraguay’s soybean production rose by 1.2 million MTs – a 13% increase. The strength of China’s demand for soybean trumps geo-political strategies (pun intended).

Further, the Chinese government plans to import more soybean meal from Brazil and Argentina, a strategy that could undermine their own soybean processing industry. Previously, China has incentivized importing whole soybeans by taxing soybean products to protect their domestic crushing industry. A move to liberalize the import of soybean meal may signify the Chinese government’s determination to not rely on U.S. soybeans in the future.

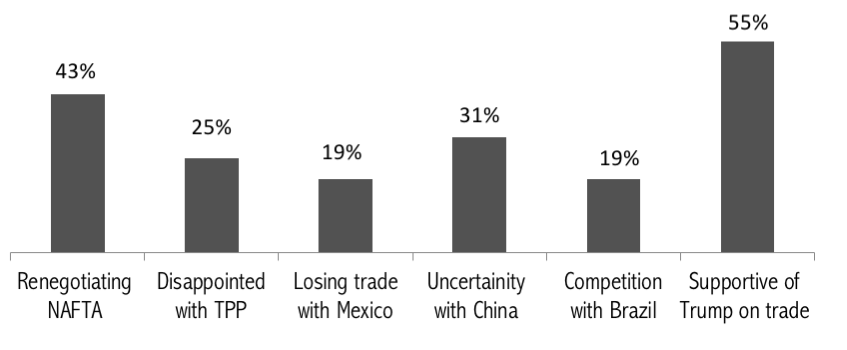

When conducting farmer interviews in 2017 and 2018, many Illinois soybean farmers welcomed retaliatory tariffs on China for what they saw as unfair trade strategies. Realizing that they would be an early victim of the trade war, many of the interviewees expressed a desire to restructure trade with China for the benefit of the country.

However, other farmers were less supportive of the administrative strategies to restructure trade with China and echoed the fears of the larger agricultural community. Many experts believe that once the Chinese market finds an alternative trade partner -- one more reliable than the U.S. in terms of production and politics, U.S. producers will have permanently lost access to and credibility with Chinese buyers.

The strategies proposed by the Chinese government suggest that they are looking for permanent replacements for U.S. soybeans and the U.S. administration has shown little evidence of backing down. The on-going trade negotiations more resemble an international headbutt between the world’s two largest economies than diplomatic policy. Both countries are engaging in strategies aimed at one another, but at the cost of hurting domestic industries.

In an increasingly telecoupled world, bilateral trade relations do not occur in isolation but within a large, complex and redundant trade network. This interconnected structure allows for multiple pathways from the area of supply to demand. Despite strategies to restrict trade flows, it is likely that U.S. soybeans would first be transported and/or transformed by a third country before entering the Chinese market. This would result in lower soybean prices for U.S. producers and higher prices for Chinese consumers, largely benefiting industries and countries in the soybean supply chain.

Nobody wins in headbutt. Well, except in this case, maybe Brazil.

See Tariffs lead to creative supply chains and the related publication

Sources and citations:

https://apps.fas.usda.gov/psdonline/circulars/production.pdf

http://futures.hexun.com/2018-08-13/193759079.html

https://www.huffpost.com/entry/michigan-farmers-trump-tariffs-china_n_5cda2da5e4b0615b0817ffe6

Herzberger, A., Chung. M., Kapsar, K., Frank, K., and Liu, J. (2019) Telecoupled food trade affects pericoupled trade and intracoupled production. Sustainability.

Wang, L., Herzberger, A., Xiao, Y., Wang, Y., Liu., J. and Ouyang, Z. (2018) Spatio-temporal Changes of Arable Land Driven by Urbanization and Ecological Restoration in China. Chinese Physical Geography.

Wang, L., Herzberger, A., Xiao, Y., Wang, Y., Liu., J. and Ouyang, Z. (2018) Spatio-temporal Changes of Arable Land Driven by Urbanization and Ecological Restoration in China. Chinese Physical Geography.

News and Analysis

-

Tariffs lead to creative supply chains

Published on August 5, 2019

MSU scholars apply a new, more holistic way to examine global agricultural trade to better understand what’s going on when a country as enormous as China develops a big appetite for soybeans. -

Today’s global farming less back breaking, more mind bending

Published on June 22, 2018

Farming has always been difficult. However, through technological advances, we can plant crops, apply precise synthetic fertilizers and harvest with ease. Yet even as uncertainty over supply has been reduced, market demand is more volatile than ever.

Print

Print Email

Email