Avoiding scams: What teens should know

Resources for teens to protect themselves from scams, fraud and identity theft.

Generation Z, individuals born after 1996, are considered digital natives with 95% of them having access to a smart phone according to recent research from the Pew Research Center. Almost half (45%) of this generation reports being online “almost constantly.”

Being online regularly makes this generation perfect targets for scammers and identity theft. In 2021, the Federal Trade Commission (FTC) indicated individuals 19 and younger reported 51 million dollars in loss from fraud. For the youngest consumers, online shopping was ranked first as the category with the highest number of fraud reports (39,415) with miscellaneous investments ranking first in the total money lost ($86,310,000).

Resources to protect yourself

Numerous agencies have been created to protect your consumer rights.

- The FTC has been protecting America’s consumers since 1914 when President Woodrow Wilson signed the Federal Trade Commission Act into law. Through the FTC, you can take action by reporting fraud, reporting identity theft, reporting unwanted telemarketing calls, and obtaining consumer tips and advice on a wide range of topics to protect yourself.

- The Consumer Financial Protection Bureau conducts research, provides educational resources, and enforces federal consumer financial laws to ensure equal access and fair practices are upheld.

- The Better Business Bureau is a private, nonprofit organization that helps people find trustworthy businesses and make informed buying decisions.

- AnnualCreditReport.com is the only source for free credit reports authorized by federal law. By regularly checking your credit reports, you can identify suspicious activity and report it quickly.

Avoiding money mishaps

Do you want to learn more on how you can protect your identity and money by avoiding scams and fraud? Michigan State University Extension 4-H Youth Development has designed, Avoiding Money Mishaps, a self-guided interactive course especially for teens. After taking the course, 89% of recent youth participants agreed or strongly agreed with the statement, “I feel more confident in my ability to avoid scams and fraud.” Furthermore, 94% of the youth participants agreed or strongly agreed, “I feel more confident in protecting my identity.” This course, along with nine other teen financial fitness courses, are available 24/7 for free through a grant from the Michigan Department of Licensing and Regulatory Affairs.

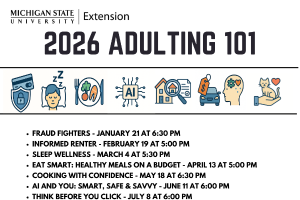

If you prefer to learn with others, MSU Extension has many virtual and in-person youth money management programs across the state. Consider following on Facebook or Instagram to stay informed of other related programs and resources.

Print

Print Email

Email