Land Division Act basics for landowners

Current and prospective owners of land in Michigan will benefit from understanding some basics of the Land Division Act.

As the name suggests, the Land Division Act, MCL 560.101 et seq. (formerly known as the Subdivision Control Act), regulates the separation of land into two or more small parcels as well as sets standards for creating subdivision lots. The statute includes numerous details – the most significant of which will be highlighted here. This article is not a substitute for reading and understanding the entirety of the statute, but rather to inform landowners of the basics.

Michigan State University Extension states that the first thing a landowner should know about the Land Division Act is that any division of land that will result in one or more of the parcels being less than 40 acres (or the equivalent) is subject to local government review. Only after that review can the owner market, sell or record the property with the county Register of Deeds. The review is at the township, village or city (and sometimes county) level. A local official, not a committee or board, is assigned the responsibility to approve or deny proposed land divisions. Most often, it is the local government tax assessor or the zoning administrator.

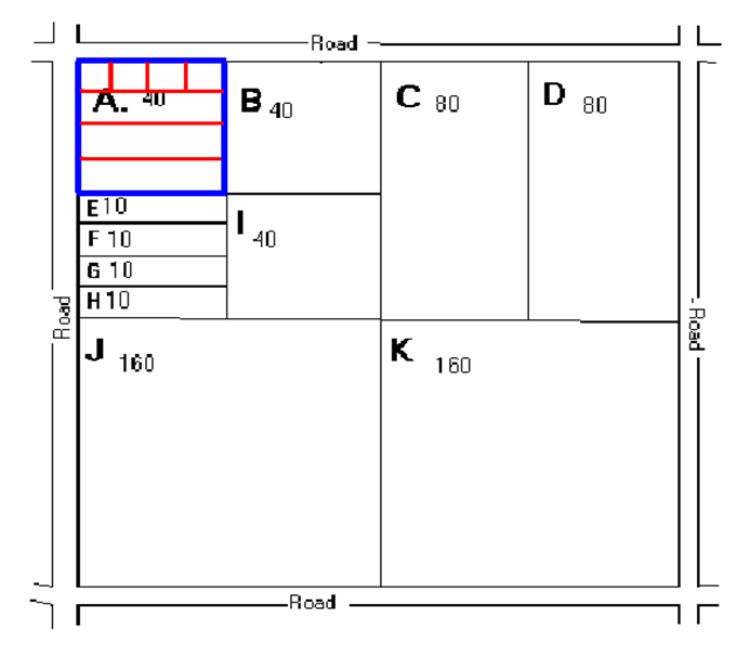

The second thing landowners should know is that the number of allowable divisions depends on the size of the ‘parent parcel.’ The ‘parent parcel’ is whatever the shape and size of the parcel was as of March 31, 1997. If, on that date, there were two or more adjacent parcels under identical ownership, then the entire land area under common ownership is considered the parent tract. In addition, land held under land contract, or land professionally surveyed and actively marketed for sale, but not recorded with the Register of Deeds as of March 31, 1997, would be considered the parent parcel. Again, the Land Division Act prescribes the number of allowable divisions based on the size of the parent parcel. For example, a 40-49.9 acre parent parcel is allowed 7 divisions; a 30-39.9 acre parent parcel is allowed 6 divisions; and a 20-29.9 acre parent parcel is allowed 5 divisions.

If the parent parcel has already been divided, a landowner might wish to determine if additional divisions can be made. One would need to determine:

- The total number of divisions allowed for the parent parcel

- Minus the number of divisions that have already been approved by the local government (even if not yet sold)

- Minus the number of divisions transferred to a resulting parcel (i.e. the number of divisions the original owner transferred to buyers of any already sold divisions)

The resulting sum is the number of divisions allowed for the remainder of the parent parcel. A landowner should explore his/her property’s deed or chain of title and consult with the local assessor to confirm the number of divisions that are available, if any. If divisions are available, has sufficient time passed in order to begin exercising the division rights (i.e. 10 years since being recorded)? If no divisions are available, because all have already been made, or because no divisions were assigned from the parent parcel, or insufficient time has passed (i.e. at least 10 years since being recorded), the parcel cannot be further divided unless 10 years have elapsed since the parcel was recorded with the county Register of Deeds. After that time, the division can be split further (referred to as re-divisions). The total number of re-divisions allowed within a division (parcel) is based on another sliding scale related to the size of the division.

The local unit of government where the parcel is located should have a detailed application form for reviewing land division requests. An application form is needed to determine the number of divisions and re-divisions allowed. This also helps maintain detailed property records. The form requires property information and history so that the land division official conducting the review can ensure that the resulting divisions or re-divisions will (from MCL 560.109):

- Have an adequate and accurate legal description;

- Not be narrower than 4:1 (parcel depth to width ratio for parcels less than 10 acres);

- Meet the minimum parcel width required in the zoning ordinance, if applicable;

- Meet the minimum parcel size required in the zoning ordinance, if applicable;

- Be accessible by a public road, private road, easement or other similar means (as required by the local land division or zoning ordinance);

- Not exceed the maximum number of divisions for the parent parcel, or the number of re-divisions for the division;

- Have adequate easements for public utilities from the parcel to existing public utility facilities;

- Not result in land-locking a cemetery; and

- Not have any unpaid property taxes and/or special assessments due for the last five years.

Based solely on the Land Division Act, the local government review of divisions and re-divisions is for the above nine things. In a local government jurisdiction with zoning and/or a separate local land division ordinance, proposed land divisions must also satisfy the standards of those local ordinances. Again, any division can be re-divided after the passage of 10 years.

From many years of experience responding to Land Division Act questions, Michigan State University Extension land use educators have found that not all local units of government follow a thorough procedure and do the necessary research to verify whether divisions or re-divisions are allowed. It is in a landowner’s best interest to complete a detailed application to facilitate having clear title to one’s land and avoid legal battles after the fact. If interested in dividing your land, contact your local unit of government at the number provided on your tax bill or local government website.

Sample Land Division Application Sample Land Division Review Worksheet

Print

Print Email

Email