Teach youth about credit cards through hands-on scavenger hunt

Youth can learn key words in credit card applications and participate in a fun activity to read the fine print.

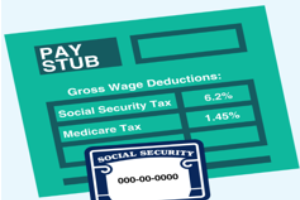

Before teens arrive on a college campus or in a store offering a free line of credit and find themselves bombarded with free t-shirts, Frisbees or low introductory rates for signing up for credit cards, it is very important to help them understand the cost of credit. Credit does come with a price. Generally, this cost comes from the interest rate. Reading the fine print on credit card applications is important when deciding whether to get a credit card or not.

According to the National Endowment for Financial Education (NEFE) High School Financial Planning Programming, there are several key components to look at with credit card applications.

- Annual percentage rate, also known as the APR. The APR is the interest rate calculated in a consistent way so it is easier to compare different borrowing options. It also may include fees and loan costs to give you a truer estimate of the total cost. For example, if a youth spent $1,000 on a credit card with an APR of 18 percent and did not pay off the balance, they would end up paying $1,180 for that $1,000 purchase. A lower APR is obviously preferable but again, read the fine print for teasers that offer a low rate for just a short time. Regardless of the APR, the best plan is always to pay off the balance.

- Annual fee. This is a yearly charge to use the card. Today, there are many cards available without an annual fee, so teens should steer clear of any card offer that charges an annual fee.

- Credit limit. This is the maximum amount that can be borrowed at any one time before there are extra charges and fees. For teens just starting to handle credit, a fairly low credit limit is preferable, if only to avoid the temptation of overspending.

- Grace period. The grace period is the length of time before an amount charged starts accumulating interest charges. If the intent is to pay off the card balance each month, the teen should get a credit card with a grace period of 25 days or more in order to avoid interest charges on purchases. Watch out for and avoid the credit cards that start charging interest from the day of the purchase.

- Over-the-limit fee. This is the fee that will be charged each time the credit limit is exceeded.

- Late fee. This penalty fee will be charged if a payment is made after the due date. Find out how soon after the due date the late fee is applied and how much it would be.

Teens and parents should be aware of a universal default in the fine print, too. This policy states that in the event of even one late fee from a borrower to any creditor, the credit card company can raise the interest rate, sometimes exorbitantly.

Once teens understand these terms, a hands-on activity may help them to see how many credit options are out there, how they target different audiences, including youth, and how important it is to read the fine print. Parents (or youth development staff) should save the credit card offers they receive (black out personal information, if applicable) and send teens on a scavenger hunt to find additional card offers at specialty stores, banks and gas stations. Review them with the teens. Teens can highlight each of the key terms above. Encourage them to look at those factors, as well as their financial plan, before considering a credit card. Through this activity, young people can see that free t-shirts and mugs are not the whole story with credit cards. It is important to do research on the credit cards and read the fine print on applications.

A helpful resource for teens is the NEFE High School Financial Planning Program, Lesson 2-1 on Using Credit with a guidebook and helpful handouts to support wise credit use.

Credit does not have to be bad if one is fully aware of how to use it and what the potential costs are in advance. Teaching young people to do this is time well spent.

Michigan State University Extension and Michigan 4-H Youth Development help to prepare young people for successful futures. As a result of career exploration and workforce preparation activities, thousands of Michigan youth are better equipped to make important decisions about their professional future, ready to contribute to the workforce and able to take fiscal responsibility in their personal lives. For more information or resources on career exploration, workforce preparation, financial education, or entrepreneurship, contact 4-HCareerPrep@anr.msu.edu.

Print

Print Email

Email