What are tariffs and how could they impact farm prices?

A review of potential tariff impacts on input purchasing decisions.

What is a tariff? How will the use of tariffs impact farm markets? These types of questions are common in many farm communities right now. While the first question can be easily defined, an answer to the second question depends on a number of factors. This article provides some context on what tariffs are, their advantages and disadvantages, and potential impacts on farm input products. Most importantly, it offers some recommendations on how to approach making input purchases to minimize price risk.

What is a tariff?

A tariff is defined as a tax on goods or services imported from another country. Tariffs can be used to provide economic or political influence, generate revenue for the country enacting the tariff, or protect a country’s competitive advantage.

When a tariff is established in the United States, a process is put in place to collect the tax. First, a product imported into the country is stopped by U.S. Customs and held until the importing company that purchased the product pays the funds to cover the tax. Once the funds are collected, the product is allowed into the country. In the case of agricultural products in the U.S., the funds are put directly into the U.S. Treasury for general expenses. Some of those funds can be allocated to the U.S. Department of Agriculture (USDA) as well. The collection of tariff taxes is how the government can raise revenues. In 2023, tariffs raised a total of $80 billion in revenue.

Once the tariff is paid, the product is allowed into the country for use and/or sale. In many cases, products that are subject to tariffs often have all or most of the tax transferred to the consumer. This results in higher prices on products. This is sometimes seen in the automotive industry to protect our competitive advantage over the importing of foreign cars.

For example, suppose the U.S. domestically produces and markets cars at an average of $45,000. At the same time, the United Kingdom (UK) produces and markets cars to the U.S. at an average of $40,000. To protect the competitive advantage of the domestic automotive industry, consider a 25% tariff is enacted on importing foreign cars from the UK. The cost of the UK cars would rise by $10,000 ($40,000 x 25%) for a total cost of $50,000. That cost could be transferred to the U.S. consumer to make domestically produced cars more competitive over their foreign counterparts.

The car scenario also highlights how tariffs can be used to potentially influence a country. Consider if the UK had originally been pricing their cars at $50,000 and dropped the price to $40,000 to increase global market share. The use of the 25% tariff could provide an incentive for both countries to negotiate a fair-trade agreement that favored both countries' goals. In this scenario, the UK’s desire to increase its market share compared to the U.S.'s desire to remain competitive in the car market. This is often an advantage that tariffs provide when domestic alternatives exist.

Tariffs on agricultural products with limited domestic alternatives

What happens when a product has no domestic alternatives, or those alternatives are limited in capacity to meet a country’s needs?

The answer to this question is often where tariffs can become a disadvantage and a concern for many agricultural products. Tariffs on products with limited domestic alternatives often offer little incentive to negotiate new trade agreements on their own. They can also lead to substantially higher prices for the consumer compared to pre-tariff prices.

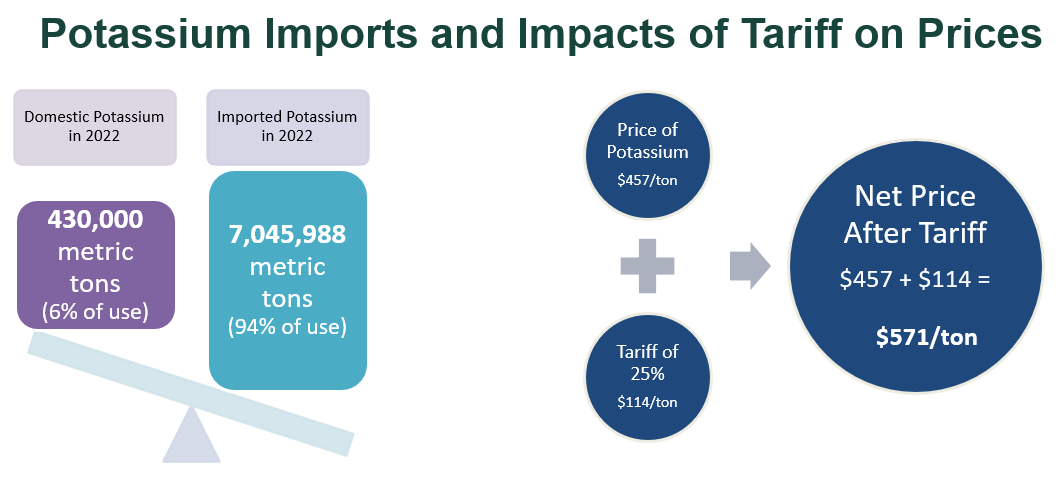

An agricultural product that serves as an example of limited domestic alternatives is potassium fertilizer. In 2022, the U.S. produced only 430,000 metric tons of potassium or approximately 6% of domestic use. The remaining 94% or 7 million metric tons needed to be imported (Figure 1). What would the impact on prices look like if the 25% tariff used in the UK/U.S. car scenario was enacted on potassium fertilizer?

Figure 1 also illustrates the impact of a 25% tariff on the price of potassium, listed at $457 per ton. A 25% tariff on all imports would increase the price per ton by $114 ($457 x 25%). The net result would be a new price on potassium fertilizer of $571 per ton after the tariff.

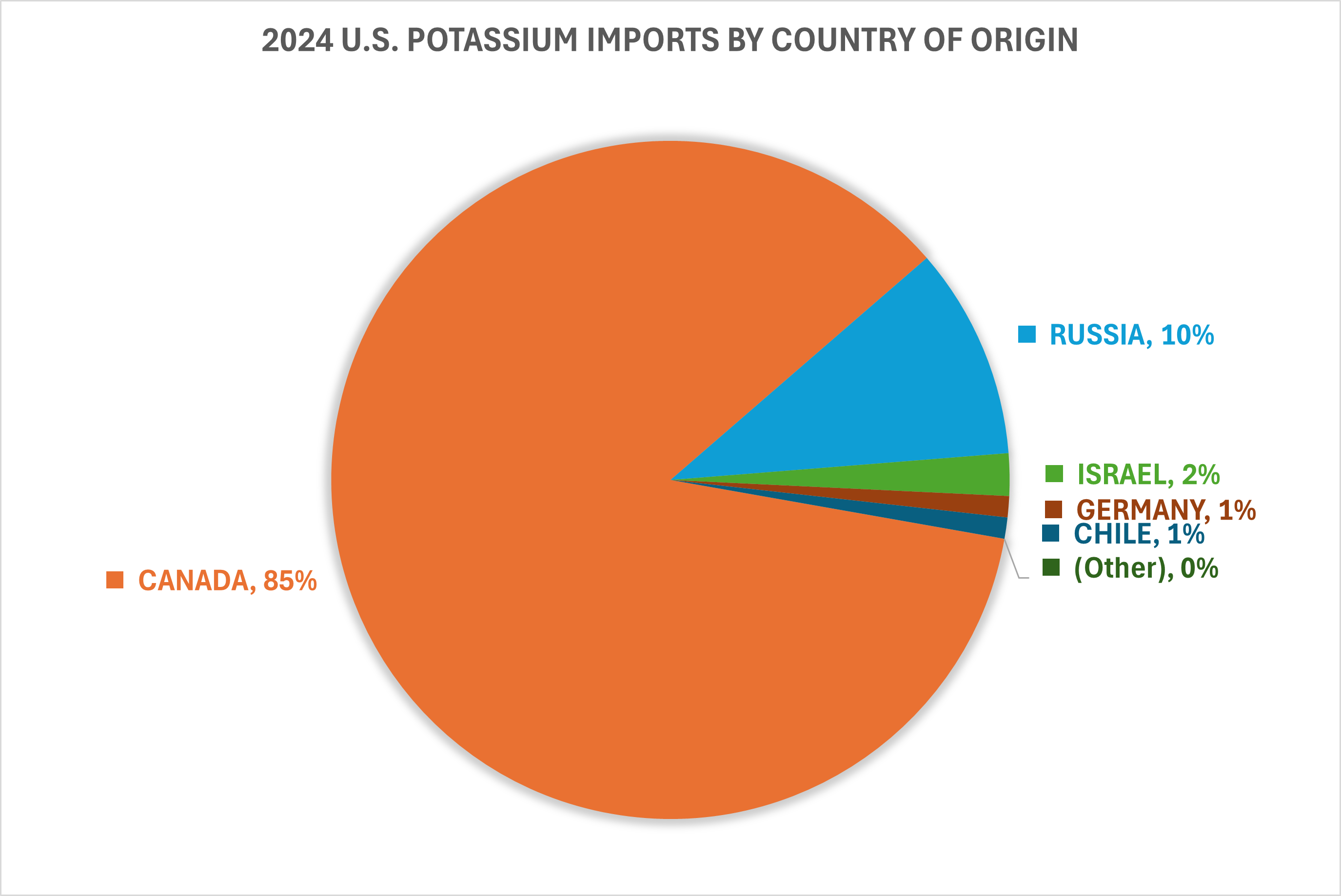

It’s important to note that the example in Figure 1 is a worst-case scenario. A tariff would need to be placed on all imports of potassium for this scenario to occur. However, there is some basis in reality when considering the amount of imports received from a single country. For instance, 85% of all year-to-date 2024 potassium imports are currently being provided by Canada (Figure 2). Additionally, the U.S. is currently proposing to implement a 25% tariff on all Canadian goods.

Strategies for minimizing price risk from tariffs

Once a tariff is enacted, it can be weeks, months or even years before the situation that led to its use is resolved. In the meantime, the consumer often continues to pay an increased price for the products they need. What options exist to minimize the potential risk of increased input prices during that time?

The most effective strategy is to take a proactive approach to meeting your farm’s input needs and minimize price risk at the purchase point. A proactive approach starts with being intentional about buying inputs that address your cropping plans. What products do you need? In what quantities? Are there alternative products that can be used to meet the same goals? In essence, your cropping plan can be adapted to an input purchasing plan to establish efficient buying strategies.

Buying strategies consider available on-farm storage, inputs with higher purchase amounts, potential supply risks and alternative product options. Physical possession offers security that input needs are met, especially if markets may become volatile or supply is a concern. Alternative products may also allow you to continue using existing equipment with minimal impact on application methods. Most importantly, purchasing smaller quantities more frequently, combined with target prices and decision deadlines, allows you to adapt to current and potential market conditions. Pricing targets allow you to be more selective in identifying good discounts or pricing opportunities, while decision deadlines keep your purchasing plans moving forward.

Another method of minimizing price risk is the potential relief from government assistance programs if farm input costs become too high. However, any relief efforts that may be offered will likely be delayed until after the impact has been experienced. This was the situation that farms experienced in 2018 when the Market Facilitation Program (MFP) was established. The program attempted to offset the impact of retaliatory tariffs against U.S. farm products in 2018 and 2019. Assistance payments were spread over several months after the impact was experienced with mixed reviews of their effectiveness for some commodities. While much has been learned since the MFP was used, any assistance program will struggle to entirely compensate for the impact of higher prices for all farms.

To learn more about creating an input purchasing plan, review the articles: Lower costs with an input purchasing plan and best practices for buying farm inputs from the MSU Extension Farm Business Management team.

Print

Print Email

Email