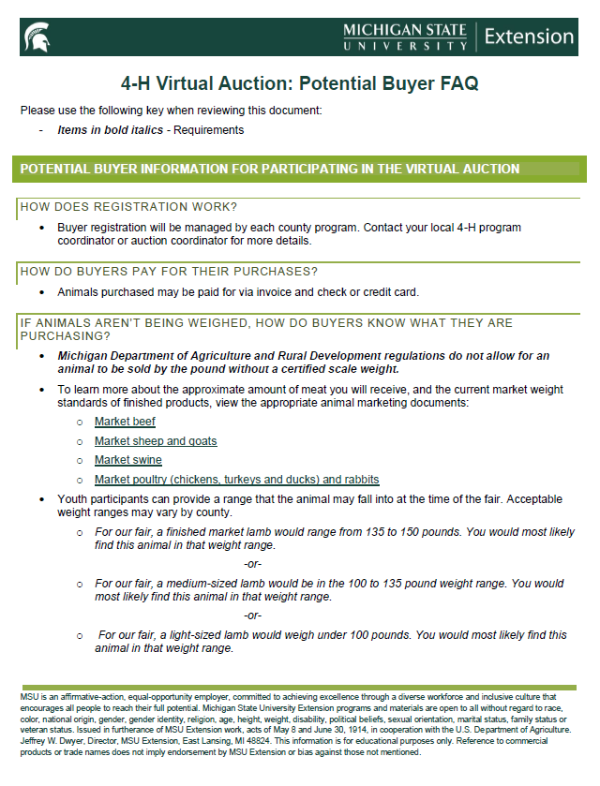

4-H Virtual Auction: Potential Buyer FAQ

DOWNLOADJune 4, 2020 - Michigan State University Extension

Please use the following key when reviewing this document:

- Items in bold italics - Requirements

Potential buyer information for participating in the virtual auction

How does registration work?

- Buyer registration will be managed by each county program. Contact your local 4-H program coordinator or auction coordinator for more details.

How do buyers pay for their purchases?

- Animals purchased may be paid for via invoice and check or credit card.

If animals aren’t being weighed, how do buyers know what they are purchasing?

- Michigan Department of Agriculture and Rural Development regulations do not allow for an animal to be sold by the pound without a certified scale weight.

- To learn more about the approximate amount of meat you will receive, and the current market weight standards of finished products, view the appropriate animal marketing documents:

- Youth participants can provide a range that the animal may fall into at the time of the fair. Acceptable weight ranges may vary by county.

- For our fair, a finished market lamb would range from 135 to 150 pounds. You would most likely find this animal in that weight range.

-or-

For our fair, a medium-sized lamb would be in the 100 to 135 pound weight range. You would most likely find this animal in that weight range.

-or-

For our fair, a light-sized lamb would weigh under 100 pounds. You would most likely find this animal in that weight range.

Is resale still an option?

- The term resale means different things in different counties.

- Often the term resale refers to animals that are bought but not intended for the buyer’s personal use. These animals are sent to a local stockyard and generally resold to a packer.

- Resale may also mean animals are sold once and donated back by the buyer. These animals are then sold a second time, with the dollars raised from the second sale going to support a local 4-H program and the second buyer takes possession of the animal (for processing or otherwise).

-

The ability to resell an animal will be determined locally so check with the virtual auction you would like to support. Buyers will not have live weights to determine exact resale amounts, but estimates can be provided based on expected market weight ranges and current market value.

Can buyers donate their purchases to a food bank or pantry?

- This is determined locally based on the availability of processing and food bank/pantry capacity. Check with the virtual auction you would like to support and also see the “Food Donation” section.

How do buyers get their purchases?

- Buyers will indicate where they would like their purchases transported to and/or processed when they check out at the conclusion of the sale.

- If an animal (or still project) should go to a residence, the seller will contact the buyer to make arrangements for pick-up or drop-off of the purchase. The seller will be directed to make contact within 48 hours of the close of the sale in order to make arrangements.

- If an animal will be sent to the processor, transportation will be coordinated by the 4-H program coordinator and/or auction coordinator. The buyer will need to contact the processor with their cutting instructions and pick-up their meat from the processor.

Are purchases tax-deductible?

- Purchases on live animals generally are not tax-deductible. Buyers should contact their individual tax preparer to know what their options are.

Food Donation Programs

How can buyers donate their purchases to a food bank or pantry?

- A food donation program offers goodwill to your community and empowers youth to make a difference. It also offers a service to the buyers who may not have a use for their meat but want to support 4-H virtual livestock auctions. Food donation is also a nice option for meat purchases that are less culturally appropriate for the buyer but may still be desirable by food pantry clients.

- Once a buyer purchases an animal, they have the option to indicate that the animal be donated to the food donation program at the time of checkout.

- If the buyer chooses to donate the animal, the animal will be processed at the appropriate facilities and the meat will be taken to the food bank or pantry.

- Effort is put in to keep donations as local as possible.

- The buyer receives a letter stating the animal was donated and they qualify for tax exemption. Letter example:

- Dear Sir or Madam:

Contributions to the ABC 4-H club (EIN 11-0123456) are considered charitable giving as it shares the Michigan 4-H nonprofit 501(c)(3) status as authorized by Michigan State University. Thank you for purchasing two lambs for $860.00 at the XYZ County Virtual Showcase Auction on 08/03/2020 and donating them to the hunger relief project. The estimated fair market value for these lambs is $XXX.XX based on their combined weight of 215 pounds** and market price of $X.XX per pound. No goods or services were provided in exchange for your donation.

Thank you for supporting our project.

**Since live weights will not be available, a carcass weight can usually be provided by the processor to determine the estimated value of the donation.

- Dear Sir or Madam:

Print

Print Email

Email