Economic Impacts of Property Tax-Foreclosure Auctions in Ingham County, Michigan, 2007-2018

DOWNLOADJune 27, 2019 - Yue Cui, Mary Beth Graebert, Jason Cox and Chang Xu

Executive Summary

The Ingham County Treasurer’s Office coordinates various efforts that assist neighborhoods in recovering from the impacts of the housing market crash and nationwide recession that occurred over a decade ago. The subsequent years saw an influx of tax foreclosed properties that further contributed to the abandoned homes, blighted streetscapes, and declining property values already prevalent in many communities. To address these foreclosures in Ingham County, in 2005 the Treasurer opted in to the statutory tax collection process in place of the State of Michigan and took over the annual property tax-foreclosure auction. At that time, in comparison to foreclosures passed to the Ingham County Land Bank for rehabilitation or demolition, the tax auction was used for a small amount of properties. The first transaction with the Treasurer as the foreclosing governmental unit was in 2006, and the first individual property that was sold through the auction process occurred in 2007. During this period when the housing market was entering its lowest point, these distressed properties were extremely limited in the amount of investment and interest they could draw from private buyers. However, as the nation’s economy gradually recovered and began to strengthen local housing markets once again, tax-auction sales grew to play a key role in foreclosure disposition.

Starting around 2012, the Treasurer’s Office began to rely more on individual offerings at the tax auction as a means to restore neighborhood stability by improving housing stock and returning more properties to the tax roll to help fund public services. Coinciding with this increase in tax-auctioned properties, the Treasurer’s Office

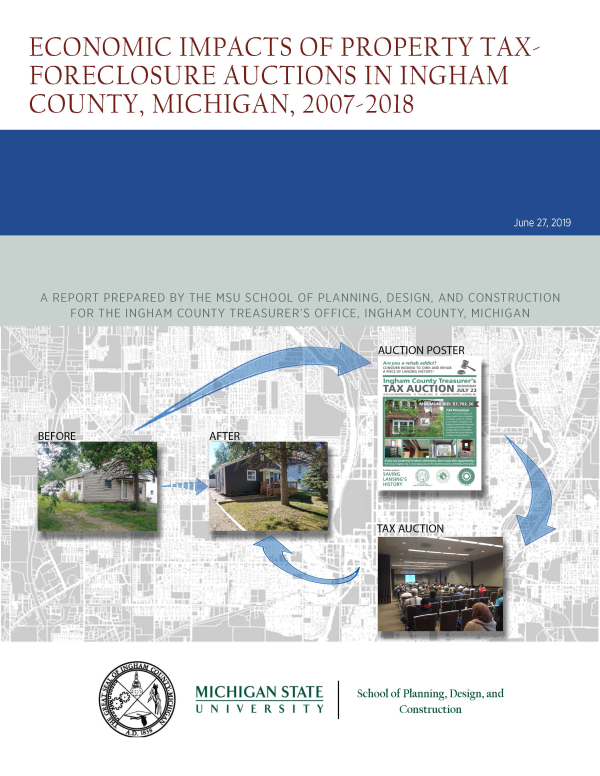

implemented stipulations such as a reverter clause on a majority of properties and owner-occupied covenants on selected homes. These requirements were put in place with the intent to help guide the market in a way that filters out irresponsible buyers unable to make necessary investments to the property, while establishing some level of accountability for the new owner. Such efforts also improve the chances of attracting buyers who are capable of rehabilitating the home and returning a quality option to the market. Figure I illustrates an example of a tax-auctioned property before and after it was renovated and resold on the conventional market.

This is the second study conducted that examines the impacts of Ingham County tax-auction activities. The first report in 2015 looked at tax auction sales for a seven-year time frame from 2007-2014, during a period when housing market conditions were slowly improving from the recession. Also, the distribution of foreclosures going to auction at that time had only recently grown to match the properties sent to land bank starting in 2013. Given that the previous study period began when distressed housing markets county-wide were most prevalent, tangible impacts of tax auction activities were more challenging to see with market conditions overwhelming the other factors that impact neighborhood stability. In comparison, the current study now has an additional four years of tax-auction sales to evaluate which provides more opportunities to observe the long-term intended and unintended consequences of the tax auction over an eleven-year span. In addition, housing markets locally and nationwide have experienced a resurgence in recent years as the economy gradually recovered, allowing for a more robust analysis that encompasses market conditions at their lowest point as well as during years when home values continue to climb back to levels they were at pre-recession.

This study examines tax-foreclosure auction impacts through three components. First, a hedonic property price analysis was conducted that explored relationships between tax-auctioned property sales and surrounding home values. The impacts that home improvements and maintenance to the tax-auctioned property have on surrounding home sale prices was also examined in this analysis. While tax-auctioned properties still show to have negative impacts on surrounding home values, this analysis indicated a positive impact on home sale prices of properties within 500 feet of the auctioned home when its owner invests in property maintenance and improvements, with an increase of $1,387 on average when the nearby home sale occurs after such investments are made.

An economic impact analysis was then utilized to determine the effects of expenditures made by Ingham County for administrative and property maintenance costs related to tax-foreclosure auction properties, as well as investments made by the new owner of the auctioned property to repair, maintain, or improve their purchase. This analysis utilized IMPLAN to assess the direct, indirect and induced economic impacts on employment, labor income and value of output for the region as a result of these tax-auction expenditures. For

the study period of 2007 to March 2019, the overall tax-auction expenditures by both the county and auctioned property owners totalled to $15,719,806. Of this total spending, $12,599,250 was found to be captured within the county, leading to a total output of $19,865,504, when accounting for direct, indirect and induced effects. From this output about 123 jobs were generated in Ingham County with $6,409,660 in labor income. Results also indicated $10,105,038 in value-added to the gross regional product during this time period as a result of auction-related expenditures.

Finally, the outcomes of tax-auctioned properties were examined to provide insight into the distribution of foreclosure dispositions over time, and how the use of the auction has grown since its inception to match improved market conditions. Reversion rates and the effects stipulations such as the reverter clause and owner-occupied covenant have on keeping the property from returning to tax-delinquency were also analyzed. Compared to findings in similar studies of tax-auction programs in places such as Genesee County and Wayne

County (Dewar, 2015; Kirtner, 2016), results indicate Ingham County’s tax-auction program and policies have much more success in preventing reversion to foreclosure, as properties with a reverter clause attached return to delinquency on average only 8% of the time, while owner-occupied covenants have similar effects with only a 7% reversion rate. This component also researched tax auctioned properties that have been rehabilitated

and returned to market, and found the average price change from winning bid amount to sale price on the conventional market has remained relatively stable over the past 5 years, with the amount of time the auction purchase takes to be sold significantly decreasing in that same time frame.

Results of these analyses illustrate the important role the Ingham County tax auction plays in processing

foreclosed properties and addressing the distressed housing market over the past decade. With the Treasurer’s Office working in coordination with the Ingham County Land Bank to manage these distressed properties, the results of this study indicate the effectiveness of this partnership in balancing the use of these tools to match market conditions.

Print

Print Email

Email