Financial Capability Education Impacts 2017

DOWNLOADJanuary 1, 2018 - MSU Extension

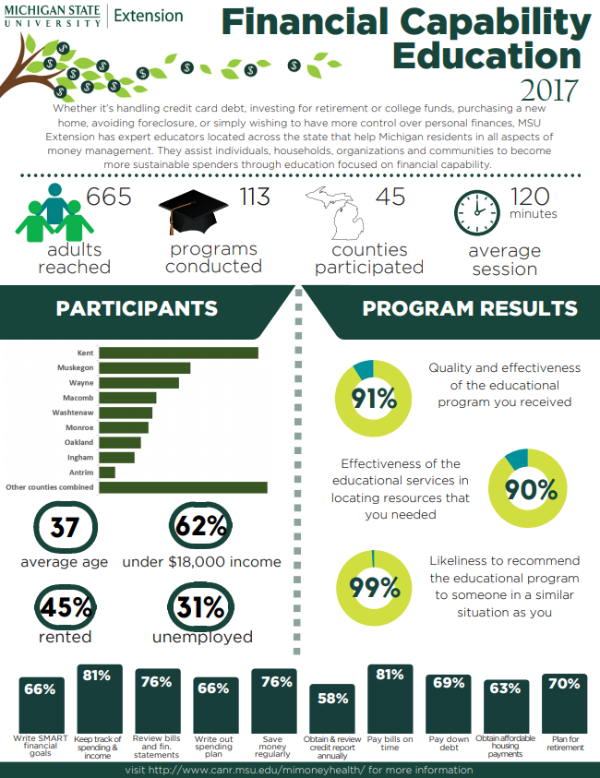

Whether it’s handling credit card debt, investing for retirement or college funds, purchasing a new home, avoiding foreclosure, or simply wishing to have more control over personal finances, MSU Extension has expert educators located across the state that help Michigan residents in all aspects of money management. They assist individuals, households, organizations and communities to become more sustainable spenders through education focused on financial capability.

In 2017, MSU Extension programming reached 665 adults from 45 counties participated in 113 programs for an average of two hours. The average age of participants was 37 years old with 62 percent reporting an income of under $18,000. Participants reported that 45 percent rented and 31 percent were unemployed.

Ninety nine percent of participants said they were likely to recommend the educational program to someone in a similar situation as themselves.The quality and effectiveness of the educational programming you received had a score of 91 percent, and the effectiveness of the educational services in locating resources that you needed received a 90 percent score.

Participant results

- 81% said they could pay their wills on time and keep track of spending and income

- 76% said they could review bills and financial statements, and save money regularly

- 70% said they could plan for retirement

- 69% said they could pay down debt

- 66% said they could write SMART financial goals and write out a spending plan

- 63% said they could obtain affordable housing payments

- 58% said they could obtain and review credit reports annually

Print

Print Email

Email