Adulting 101: Wealth Building

April 15, 2025

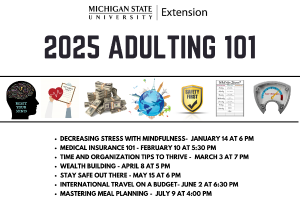

Follow us on FacebookAre you ready to leave for college or be out on your own? Are you prepared to do adult tasks and have skills to be successful? Michigan State University Extension's Adulting 101 programs help teenagers and young adults demystify the obscure reality of being an “adult” through engaging educational sessions. Each FREE session is packed full of important life skills and tools necessary to live independently!

Adulting 101- Wealth Building

Learn the essentials of saving and investing to grow your financial future. From creating a savings plan and exploring various products to understanding different investment options and evaluating risks, this course equips you with practical tools for smart financial decisions. Plus, gain insights into setting financial goals and finding the right financial advisor to guide you along the way.

Video Transcript

Well, again, welcome. I'm so glad that you're here to join us this afternoon. We're super excited to bring this topic to you. It's been very popular. It's entitled Wealth Building. And real quickly, I just wanted to share that I am a part of the Financial and Homeownership Education Team, and we are a HUD Approved housing counseling agency, and I am a HUD approved housing counselor. So real quickly, MSU Extension is a part of Michigan State University. We are both equal opportunity employers, and all of our programs are in fact open to all, and we do not discriminate on any of the protected classes as well as those additional that you see listed here. Real quickly, our mission is to help people to improve their lives through an educational process that applies knowledge to critical issues, needs and opportunities. And so we actually have representation in all 83 counties across our state. So real quickly, a little bit of housekeeping. Everyone has seemed to have find the chat pod, which is awesome. I'm so glad that you joined us. And for those of you who have just joined, feel free to go ahead and let us know where you're signing in from. But I wanted to share that we want you to be a part of this as much as possible in this one dimensional format. So utilize that chat pod for any comments or questions. I may periodically ask some poll questions. And if you have some thoughts or questions throughout the session, please type those in, and my counterpart, Kathy, is going to be kind enough to help me monitor that chat pod. So let's go ahead and dive in. So this is our lofty agenda. We're going to talk about what, of course, saving because that can definitely help with wealth building, and we're going to talk about how having a plan can really jumps and amplify those saving goals. We're also going to talk about how do you grow your savings and what are some of those products and opportunities that will help you make the most of that saving behavior. We're also going to talk a little bit about investing, and while no, we're not investment or financial planners, we can talk about a general overview of different products, services, how to anticipate and evaluate risk, and again, the different types of investments that are available, and you'll learn that some of them may be better suited based on the goals that you have. So what is wealth building? Well, it's the process of generating long term income through multiple sources, and that could include a lot of things such as a job or a wage earner situation, maybe savings and investments, and even income generating assets. And I'm going to talk about some examples of that today. So again, I think the biggest takeaway in this definition here from fortune building or fortune builders is that wealth building really relies on proper planning and insight into what your particular goals are. So let's go ahead and dive in. In the chat pod, we would love to know what is your big savings goal? Is it one of the things listed on the slide here? Because these are often the top three. It could be education, home ownership, or retirement, but maybe yours is different. Maybe you're trying to pay down debt, maybe you're saving for college education, whether it be yourself or a partner spouse or even a child or relative. When you think about saving money, what are some of the big ticket items you're hoping to save money for? It looks like someone has typed in maybe moving, and that can cost a lot of expense, not only hiring a moving company, but oftentimes those initial deposits, particularly if we're renting. Maybe if we have a pet, we'll often have that extra pet expense, building wealth after college. I remember it took me a long time to pay off my college student loans, saving for retirement. Yes. Okay, so someone just bought a house. Wow, with cash, that's hugely impressive. Congratulations, Wendy. Retirement in the Caribbean. Oh, I'm super jealous. Awesome. A new power in retirement. So just in a little bit we've seen thus far, you can see some overlap, but you can also see some diversification in goals. And what I really liked about some of you who listed more than one, I really want us to think about that because we certainly can strategize and save for more than one goal at the same time. So let's talk about some tools that's going to help us get there in as fast as time as possible. So let's talk about how a budget can be a great resource to do that. And the reason why is really, it's a passport to a healthy financial life. It's going to let you know how you use money, and it's going to help you feel more in control of your money instead of your money controlling you. One thing I do want to put a quick shout out to is that we do have a free 1 hour make a spending plan work for you webinar, and I'm going to put my website in the chat pot before we end today. So if you want a little bit more support and encouragement in how to create a spending plan, know that we have that free webinar also in our repertoire. So when we think about a monthly budget, obviously it lets us know what money is coming in, but it also helps us look at where our money is going. And sometimes we have a better handle on that than we realize. But why I like this particular pie chart here is this is one example of some recommendations of where our money should go each month. Now the reason why it's important to know where your money is going is you want to be able to decide, Hey, are my daily choices honoring my goals and values? If not, where can I make changes? If I'm paying for a ton of streaming services I don't have time to use, might that be a place to make some changes or cuts? Because any money you can free up in your monthly budget, you can put towards what those goals are that are important to you. Real quickly, I want to zoom in on food. Notice that food says, of your monthly gross income, only ten to 20% should be going towards food. But I'd like you to think about real quickly in your own situation, what do you think per month, the percentages you spend on food? You have to include fast food. Is it 31 to 35%? Is it 10% to 15%? Maybe you're not sure. But the takeaway here is we're not picking on eating out, but eating out comes with costs. We're paying for that convenience. So when we think about looking at our own choices and values, the whole idea here is where can we make some changes? Hey, shout out to Wendy. She was honest. She gave us the 16 to 25% bracket. So again, every situation is different, of course, but what we want to try to do is look at where can we maybe make changes to free up money to save for our goals. So when we're talking about a savings plan, we have to think about what can you commit to savings and or possibly changing in your monthly budget? And when are you going to start this goal? I sent you a slew of handouts. I believe Kathy sent those or maybe she'll send them afterwards. Yep. After. Okay, perfect. So one of those handouts does include a goal setting template. And so it will really help you look at is this goal, short term, medium term, or long term? And that's going to be important because that will help you prioritize just how much you're going to set aside each month. And so, again, with financial goals, whether again, they're short, medium or long term, in addition to knowing how much we need to save each month, we also need to know our timeline or time horizon. And I'm going to talk a little bit more about that today. So you listed many reasons to save in the chat pot. A couple more that I wanted to just put some emphasis on is the notion of an emergency savings. One of the recommendations in the whole world of personal finance is that we do have something put aside for the unexpected. Two ways to think about an emergency savings is one little pot or pool for unexpected small expenses, but also thinking about being more intentional and saving for the unplanned loss of income. That's where you've maybe heard that rule, you should save 3-6 months of your income or expenses. The takeaway that is that if your income were to stop unexpectedly, could you stay afloat while you try to figure out a backup plan? We talked a little bit about large purchases already, buying a home, a new vehicle, maybe taking a vacation, And again, we talked about education, and many of you talked about retirement. Another quick shout out, we have a great webinar called Retirement Myths and Facts that might complement today's topic for you. So let's say you're new to the whole things, all things savings. There's a great easy way to start to jump start savings behavior, and it's called the 52 week savings challenge. It's really simple, and it's again, designed to occur over a whole time frame of 52 weeks. And the whole goal here is you're going to snowball your savings. So week one, you save $1. Week two, you save two. Week three, you save three and so on. And after 52 weeks, if you stick with this, you will have saved $1378. So again, starting small is okay. The idea here is to be comfortable and consistent with saving behavior. What I also want to talk a little bit about are some different products that can also amplify or enhance your saving behavior. There was a time in my life where I worked in a credit union and I can tell you that some of the products we're going to talk about here you can find at banks or credit unions. So some of the things to keep in mind are savings accounts, certificates of deposit or CDs, and money market accounts. And why these are great for sort of those beginning savers, there's low risk, which is always good, but do understand there's low return. Interest rates are often lower on these products. Also, too, a benefit is these things are insured against loss by the financial institution, and that's true for both banks and credit unions. Now, I did a little bit of research recently, and again, this is just generic ballpark, but some national trends on CD interest rates for some of the lower term time frames are 1.53 to 1.83%. Now, again, it depends on how much money you're putting into a CD and how long you leave it in there that totally will dictate the interest rate. That interest rate can certainly go up higher if you're putting more money for a longer period of time. One thing I want to zoom in on is that last bullet. We really want to make sure that you understand the importance of liquidity. You want to make sure that whatever you put your money in, you do have some access to your funds that are free of penalty. So an example would be if you have $2,000 to your name and if you put all of that $2,000 into a CD, that money isn't liquid because a CD is designed for you to leave it there until it expires or matures, and if you take it out beforehand, you get penalized, you have to pay a fee. So not putting down CDs, but we do want you to understand you always want to have some money liquid if possible so that you can have it in case of an emergency without being penalized. So what are some potential saving venues you could also maximize from an employment setting? Great question. Many employers will offer things such as a 401K or 403B account through employer sponsored defined contribution pension accounts. Your employer will pay a plan administrator to administer these, answer questions, and provide these for the workforce. And really how it works is pretty simple. Every pay period, you're going to have some money immediately taken out of your paycheck before it reaches you and it's going to be put into these tax deferred products. Now, one of the things to think about is these tax deferred are great because they're pre taxable income. Another thing to keep in mind is that some programs offered by employers are called matching programs. So if you decide to put a certain amount into one of these products, they may match what you put in up to a certain amount, and that's free money. So if you aren't utilizing a program or you haven't investigated it through your employer, It's always really good to look into because this is automatic, and it's often easy to not miss what you can't see, and that can really jump start and expedite saving, particularly for retirement. So again, if you do have this offer from your employer and you're not utilizing it, definitely would encourage you to look into that. Oh, so Keisha said they found a $500 CD for six months that pays 4%. Awesome. Awesome. So again, those interest rates can change frequently. Many lenders will have them on their websites, or you can walk to a branch and say, can I get one of your rate sheets? But Keisha, you did your homework. That's pretty good. So thanks for sharing. That's awesome. So again, what are some other products that we can look at when we're looking at savings, for example, retirement? So let's talk a little bit about IRAs. There are two different types of IRAs. There is the traditional and the Roth, and I'm going to kind of break these down for you a little bit. These products are initiated by you, an individual. They're not something that your employer is going to per se investigate for you. You have to initiate that. Now, with the traditional IRA, it's tax deferred until you withdraw the funds, okay? Now, with a Roth IRA, it's separate. It's actually reversed. With a Roth IRA, when you put money into that initially, it's taxed initially. As it matures and grows over time, when you decide to finally take it out, you won't pay taxes at that time because you've already paid them upfront. So they are designed to be different in regards to the space of taxes. Again, they are insured against loss, often by a financial institution or some other type of backing, and interest rates can vary so much like Keisha did, you got to do your homework. Also, too, keep in mind that these are designed for the long haul or the long term. There can be penalties for early withdrawal. They are designed for you to leave those monies in there until about age 59.5. And again, a different notion about that traditional IRA, it does require an RMD. Now, what is an RMD? RMD is a required minimum withdrawals or distributions after age 72. So what that means is if you have a traditional IRA, at age 72, you have to start taking out a portion, otherwise, there can be some ramifications. Is there there was a question in the chat. Is there a reason to opt for a CD over a high yield savings account? So again, a couple of things to think about with a high yield savings account versus a CD. Really, it's going to come down to a couple of different things, your goals and personal preference. Again, these would be things you could pursue simultaneously, but keep in mind some of the differences. With high yield savings accounts, you often have to keep a certain minimum in there to get that high interest rate. The other thing to think about with, again, a CD is that it's not accessible or liquid. Again, how much you're going to earn is going to be contingent upon how much you have in each account. And then again with that CD, how long you're willing to save it. So really good question, and I'm not trying to dodge it, but it does come down to needing a little more information. How much asset do you have to work with and what are your ultimate goals? And again, don't forget with many of those high yield savings accounts, if your minimum monthly balance on that account falls below a certain amount, you often won't get that great high interest rate. So it always comes down to doing your homework and reading the fine print, but that's a really good question. All right. So let's talk a little bit about some college savings accounts. Not many of you talked about that as a goal, but it might be applicable for some. Do you know that in each state, oftentimes they have their own specific state savings program that are tax deferred. In Michigan here, it's known as the Michigan Education Savings Program. Also, I've seen it also called MEP. And again, what's nice about these programs is they're designed again, you put money in, it's tax deferred and you leave it in there for the long haul. Again, what's great about these is these can not only fund tuition, but oftentimes they can pay for additional expenses associated with that college experience, possibly books or maybe even lodging. Again, super important to do your homework. There can be some variants in these programs. If you're not exactly sure where to find it in your state, reaching out to your state website is a great place to start or just searching 529 plan in your particular state. But this can be a great way to save for college education. So I'm super excited about these next few slides because I think this kind of dovetails a little bit on some of the questions we've had so far about what are some of those different programs and what might be best for me to pursue. If you have a college saving account for grandkids and then they don't go to college. Great question, Wendy. it comes down to the program. Some programs will allow you to transfer those funds to another child and/or relative, and some won't. So super important that you look at the summary plan description associated with that particular product. And if you are a little bit worried that that could happen, you want to really investigate now what your options are because some plans will let you transfer those funds and some won't. So great question, Wendy. But again, do your homework because if that were to happen, you want to know what your options are. Okay, moving forward, compound interest. I love compound interest. So let's talk about what that is. So compound interest is money grows by being invested in an interest bearing account. So this is what we receive for letting others use our money. So when I put money into a product that's going to be in there for the long haul, and I'm fortunate to gain compound interest, the benefit to the facility or lender is that my money is sitting there for a long time, so they can actually lend it to other people, but they're going to give me a nice high interest rate for that particular benefit. Do we have to be at all webinars? No. I've suggested a couple that may complement your goal, but you don't have to attend all those. It's personal preference. Good question. This particular Graphic does a really good job of helping us understand what's the difference between compound interest and simple interest? Both are important, both help us earn money, but there's a big difference between the two. And for those of you who are younger listening in today, you have the benefit of time on your side. So if you have the ability to start saving sooner than maybe some of us did, that time on your side is really going to pay off over the long haul. So let's break down this example and understand what it's saying. Notice along the bottom of this graphic, we see zero to 20, so that's our time horizon, that's our time frame 20 years. What we're going to talk about is two different fictitious scenarios. Again, this is no guarantee on return on investment. This is purely for conversation only. Let's say a person had $1,000 and they wanted to put it into an interest bearing account to earn money over 20 years. That green bar at the bottom, that is our $1,000 principal, that's our asset. If we put it into an account, that's simple interest bearing, it means it earns interest every month. But it doesn't compound the interest. Notice what happens after 20 years. This is the blue bar. After 20 years, my $1,000 has grown to three grand. So I've earned $2,000 in an interest bearing account over 20 years at an interest rate of 10% per year. Now again, as I'm saying, no guarantee. But what if we decided, you know what? We really want time to work in our benefit. I plan on leaving in this product for 20 years. Is there a way I could earn even more money? There is. If you put it into an interest bearing account that compounds interest, we can earn more money. The reason why is not only do you earn interest on the money that you initially put into the product, you also earn interest on the interest you accrue. That's the notion of compounding interest. Now let's look at that same scenario, everything being the same 20 years, we started with $1,000. We're assuming and hoping for a 10% interest rate every year, but notice what happens in the blue bar, excuse me. We have earned so much more. Notice that our balance on that account is about $7,200. So my $1,000 principal, I've earned about $6,200 just because of compounding interest. Again, if we are a younger adult, you have the benefit of time on your side when you're looking at the difference between simple interest bearing which doesn't compound and compounding interest. All right, let's continue on. Real quickly in the chat pod, we would love to know. Do you have a savings account? Again, this is personal preference, if you want to answer it. Some will say yes, some will say no, I'm thinking about it. Maybe someone's saying, yes, I'm going to initiate that next week. Just helps us get an idea of what your familiarity is with financial institutions and your comfort level. So I see here that many of you do, and that's exciting. I think what I would also want you to know that is if you haven't already maybe had a conversation with your financial institution, you can often have a primary savings account, but you can have sub accounts under that particular account. So let me say this another way. Maybe you have a portion of your paycheck going into a savings account, but maybe you have two saving goals at the same time. You could actually have sub accounts within your savings account. So when your deposit hits, you can also decide to have money split into different accounts. If that's your choice. It can be a way to help to strategize and make sure you're intentional about saving a specific amount per month per goal if you want. Sometimes people don't know that. Some are saying they have an emergency account. So say they've had them since they were 12-years-old. That's awesome. Other people say they have one for an emergency fund. Let me see here. Yeah. One of the questions was, how much money should you save for? And I think it was for an emergency fund. Okay. So again, two different types of emergency funds, and this is per our curriculum Dollar Works too from the University of Minnesota, they recommend a small generic emergency fund is at your discretion. They said a minimum $25. It's up to you to decide. That's for small unplanned emergencies, but Excuse me, I have allergies. But when we're looking at unplanned loss of income, the recommendation is three to six months worth of income and or expenses, whatever you choose. I always tell classes that I teach, in my professional career, I've lost two jobs and it wasn't because of my work performance, it was because funding for the position was eliminated. I can tell you personally that emergency income fund helped keep my family and I afloat until I was able to find another job. So that's what that's designed for. Hope for the best but plan for the worst kind of thing, right? Don't forget an emergency fund is thought of as two different buckets. They have two different purposes. There was another question and I want to make sure that in case I missed it, once and when is I think the best time to save. What I would say is that we're going to talk about goals. We're going to talk about saving strategies for goals. But I did want to stress too, there are some rules of thumb with savings. If we're not quite sure maybe we're saving for anything in particular right now, but we want to make sure we're mindful about savings, a rule of thumb to consider is 10% per pay period. Now, that doesn't mean you have to do it every pay period and that doesn't mean it's always feasible. But if you're not sure what you want to save for right now, but you know maybe savings is important, that could be something to aim for, and that could be a combination if you so choose, of your personal saving behavior, in addition to what maybe you're saving through an employer sponsored retirement plan, you have leniency. It does come down to personal preference. Good questions. Keep them coming and if I missed them, Kathy, she'll let me know. All right. Let's continue on. So we're going to talk now about safe versus unsafe investments because risk tolerance is a big deal. You're going to get a handout on that. Everybody has a different risk tolerance. So if we're not a risky person by nature and we're a little bit nervous about losing money, we do need to understand what's considered a safe investment. So a safe investment is a situation where you won't lose your money. It protects your principal, that's the money that you initially start with, and it has low volatility. So what that means is whatever that money is put into and pooled, it's non risky investments, and that helps ensure that your principles protected. It does help increase your profitability of meeting your objective. But one thing to keep in mind with safe investments, they often have a lower yield of interest. An example would be a primary savings account or a high yield savings account. Those are guaranteed, they're safe. You do earn a little money, but they may not be as high interest earning as other products on the market. So again, I mentioned risk tolerance. It's the degree of uncertainty that you're willing to take to achieve a potentially greater reward and it's determined by a couple of things. It's determined by your investment goal, your experience, how much time do you have to invest and your other financial resources, and don't forget that last part and your fear factor. For me, I am very non risky. I go to restaurants, I get the same menu item. Very low risk. That doesn't mean that's a good thing. I'm just telling you what I am. So people are super risky. They like to skydive, and they like to be more maybe adventurous. There's no right or wrong. It just comes down to personal preference, but it is super important to understand your risk tolerance before you start putting money into financial products and services. Again, you will be given a good handout to help you assess your own personal risk tolerance. So this is one of my favorite slides out of the whole PowerPoint because I think it speaks to everybody who's on the call. So it says here, how much risk should I take or avoid? And notice at the very bottom, it talks about how long do you have to save? 40 years all the way down to two years. Regardless of your age today when you're joining us, this speaks to all of us. It says here, adjusting the mix between stocks, bonds, and cash based upon your goal, your time horizon that you have to reach your goal, and the amount of risk you should take or avoid to meet your goal. Now, this is not an investment advice per se, but it's a guide of things to think about based on how long you have to leave something in. Let's look at an example. Let's say I was a younger adult. Let's pretend because we all know that I'm not. But let's say I was a younger adult and I had 40 years to save. Based on this graphic here, I'm considered in that long term space. So I might think about zooming in on that brown section or the bottom section where it says diversified stocks. Because I have a longer time frame to invest, it might make more sense for me to put more money into things that may be a little bit more volatile because I have a longer time frame to recoup if something doesn't do as well. But now let's look at the other side of the coin. Let's scroll all the way to the bottom to where it says two years. I only have a short time frame to save money before I need this money for whatever goal it might be. Notice now that the bigger piece is the green section, diversified bonds and cash. Remember what the important thing is with cash, it's liquid. I can get to it right away. So there's a lot of things that can go on in between the 40 years and two years. But the takeaway here is it really is important to understand how long do I need to save for the goal that I have in mind? And that will often dictate what products are best for me based on preference and volatility and the assurance that those funds are going to be there when you need them. So again, I really like this because I think it gives a good idea of things to consider depending upon how long we have to save. Now, I talked about safe investments and I wanted to zoom in on two different entities, super important to understand. I've talked about banks, I've talked about credit unions. If you have money in the bank, there's nothing wrong with that. Know that your investments are insured by the Federal Deposit Insurance Corporation. I'm sorry, they insure all bank deposit products, savings accounts, checking accounts, et cetera What if you have a partnership or a relationship with a credit union? You also have protections. The National Credit Union Administration, Again, they ensure credit union deposit products. The biggest difference between banks and credit unions, banks are often overseen by a board of directors. Often credit unions are overseen more by the membership. Oftentimes, with the credit union, you have to keep at least a $5 minimum in your savings account to keep your membership open. Another consideration with credit unions is sometimes their fee structure are a little bit lower. So again, always personal preference, do your homework and choose the institution that provides the products and services that meet your goals and are convenient for you. So I see a couple of people are late, a couple of people had to leave. Thank you for letting us know you're here. We appreciate that. And again, we'll keep rolling here. So I've talked about safe investments. I've talked about what are those entities that insure our monies in banks and credit union. But now we need to talk a little bit about what are insured and what are uninsured investments. Now remember, with uninsured investments, they may lose value and they're not guaranteed. So let's talk about insured programs first or products first, checking accounts, savings accounts, money market accounts, certificates of deposits, or we talked about earlier, CDs. They're one and the same, and cashier's checks. They are insured from loss up to $250,000 per person. So what's not insured? Annuities, mutual funds, stocks, bonds, government securities, municipal securities, and US treasury securities. Again, they could lose value and they're not bank guaranteed. So remember, when we talked about our risk tolerance, this is really what that's speaking to. What is your comfort level in regards to where you want to put those funds and how likely are you going to achieve your goal? So kind of a quick summary, and we'll keep on going, but I do like this slide because again, it's kind of reminding us of those steps to take because sometimes this can be a bit overwhelming. So what are the sequence of investment decisions? What's my goal? What's my time horizon? How long do I have to save for that goal? What's my risk tolerance? And being sure to consider allocation and diversifying. That means quite simply don't put all your eggs in one basket. If you have a certain amount of money to invest in something, will you have better outcomes and success if you put it in more than one product in case one of them doesn't do well? That's what it means to allocate and diversify. Then again, which specific investment should I select? So here's why I want to put a quick plug in to let folks know that if you are fortunate enough to have an employer sponsored plan, you don't have to go about this alone. Your employer is paying for that plan administrator to not only implement the program across the workforce, but they're there to answer your questions for free. You can set up phone conversations. So you can arrange in person meetings, but they're there to answer your questions to make sure your investments are honoring your risk tolerance and your goals. So how much do I have to save to reach my goals? And I think this question was actually in the chat pod, so this is a nice segue. So again, am I saving for an emergency fund? Is that my primary goal? And again, we talked about two buckets, small unplanned expenses and that emergency income fund. And, you know, the emergency income fund, that might be a long term goal. That could maybe take you a year to a couple of years to save. So it depends on what your goal is. What about paying for college education? I know that Kathy and I together over the years, we do provide periodic seminars or webinars on saving for college. And some people are fortunate. They have ten years to save for college. Some people are going to go to college in six months, right? So depending upon your time frame really impacts where you can put that money to save for college. What about current income during retirement? Maybe we're in the workforce right now, but retirement is starting to get closer and closer, right? We know what we're earning now, but what's our income going to look like during retirement? And in part, that's going to depend upon what type of investments have we participated in. There's Social Security, yes, we're fortunate it's still there right now. Who knows what will happen down the road. But also, do you have money invested in other products and services? So if you want to save and grow money for retirement, let's say your time horizon is 20 years. That is really going to dictate different options you have versus if you're trying to save for maybe a large ticket item and you only have 18 months. So again, keep in mind how long you have to save will dictate often those products you're going to put your money in. The other thing to think about is some people are really passionate about wanting to leave an inheritance for their loved ones. They want to continue on wealth building for those that they leave behind once they pass away. So there's a variety of purposes and reasons to save. So how much money will I need to reach my goals? Well, again, in summation, everyone has a different amount because it's based on your goals. Your goal might be different than mine. When you begin saving and if there are financial bumps along the way. Maybe you start a savings program when you're doing fantastic, and then maybe you have an unexpected car repair and you have to use some of that money for that car repair. Don't feel like you failed, that's what that money is there for. Those are some bumps along the way that can happen. Once you get through the mini crisis, then try to get back to your savings behavior as soon as you can. One thing I want to stress is that finra.org has great online calculators for different products or I'm sorry, for different things you're saving for, Kathy's put it in the chat pod. But there are great online calculators for a variety of things, paying down a mortgage, saving for retirement, and other types of goals. Definitely know that that's a reputable site and if you want to play around with some different calculations, we would highly recommend it. So again, a little bit more thought about matching your financial product to your time frame. So the general guidelines is if your goal is two years or less, you might want to think about cash or general savings accounts or maybe even CDs, just making sure that they're going to mature at the time that you need them. Now, money market accounts, we haven't talked a lot about those. They often will fall into that bracket of a higher yield savings account. But with money market accounts, sometimes they have restrictions. For example, They may only allow six withdrawals per month, or they may only allow a certain amount of deposits into that account per month. So always read the fine print, but oftentimes money market accounts will have a higher interest rate than your standard savings account. But what if my time horizon is a little bit longer? Maybe I have anywhere 2-10 years to save for something. Well, if that's the case, you might want to consider a combination of things such as stocks and bonds. But what if you have over ten years? Again, consider mostly stock, but depending upon your investment objective and your risk tolerance because what we learned before, stocks can fluctuate, they can change. Now one thing to keep in mind is because we hear a lot about this in the media is cryptocurrency. There's going to be one slide, only one slide we're going to talk about on this. We do want to stress, though that it's considered a risky investment, and we'll talk just a bit more about that in a few minutes. So real quick for fun, if you're willing to share, do you consider yourself a risk taker? Yes, no, or sometimes. I've had people sometimes say to me, You know what? I'm a risk taker when it comes to menu items, but I'm not a risk taker when it comes to my money. So maybe it will depend on different categories. Some of you are saying, definitely for sure, others are like, no way, I'm not. There's a couple of you that are somewhere in between What we're seeing across the spectrum, which is super fun. But again, that speaks to our uniqueness, right? We are unique and that's what's so exciting. This will help you as you start to look at what are some of those things I'm going to consider when I'm looking at wealth building. Again, thank you for sharing super fun. I really like the commentary. All right. Continuing on. What are some best practices and pitfalls to avoid? I really think these are helpful because sometimes we can get a little bit stressed out when it comes to saving and rightfully so. It says, Keep in perspective. Downturns are normal and typically short. Now, again, for those of us who have been through some heavy hitters like the foreclosure crisis of 2007 through 2009, they can be pretty scary sometimes. So you do know that they happen, but try to, you know, keep calm and carry on, right? It says, Create a plan you can live with through market ups and downs. Now, I think that's really good advice because if you're doing something that's so stringent right now and you're barely able to kind of make it with your goals, what if the market tanks? Are you still going to be able to stay afloat? Focus on time in the market and not trying to time the market. Also, too, it's a good idea to keep investing even in bad times. Gosh, that might even sound counterintuitive. But again, some things to keep in mind. Last but not least, get help in managing it down market. If the market does start to take a downturn, it's negatively impacting your investments, reach out to that plan administrator, have a conversation, and see if you need to make some adjustments based on what's going on at that time frame. So stocks, we're going to start to break down different products now and talk just a bit more about them. So stocks are a type of security that gives stockholders a share of ownership in a company. They are purchased or sold through a stock exchange or over the counter marketplaces, and the two most well known stock exchanges are the New York Stock Exchange and the NASDAQ, which is also known as the National Association of Security Dealers Automated Quotations. Try to cite that five times fast. Bonds are a debt security, so they're almost similar to an IOU, and they're issued to raise money for a certain amount of time. So if you buy bonds, you're often buying IOUs. And there are different types. There are corporate, municipal, and mutual fund bonds. Let's talk a little bit more about mutual funds. Again, we hear often about these in the media. So a mutual fund is an open end investment or fund. It pools money from numerous investors and invests in a combination of things, such example, stocks, bonds, money markets, or other securities, and even sometimes cash. So investors will purchase shares, and there is a fund manager who manages the risk and portfolio. So there's actually like a quarterback who's managing what goes in and out of that mutual fund. Keep in mind that many retirement accounts are invested in mutual funds, and they are registered with the Security and Exchange Commission, which is important because you want to make sure that if you are considering putting money into a product, you want to make sure that it is registered with the SEC because they investigate those different types of products to ensure their legitimacy. I promised the one slide on cryptocurrency, and here it is. What is the definition? It's a digital asset designed to work as a medium of exchange where an individual coin ownership records are stored in a computerized database. So it's not a tangible entity, it's an electronic entity. Again, let's look at the risks. They're not regulated, there are no protection, so the risk of losing your investment is very high, and that's really all we have to say about cryptocurrency. So I promised we would talk about what are income generating assets. So income generating assets can be things such as real estate, right? You know, if you're going to possibly buy a building and lease it to businesses or maybe you're going to buy a duplex, maybe you're going to live in one side and rent out the other. Certificates of deposit can actually be an income generating asset because remember, they earn a nice interest rate as long as you don't take it out before it matures. Stocks can provide in generating asset in the form of dividends, for example, from blue chip stocks, and then bonds, municipal or corporate and even small businesses. If you invest in a small business, you can often benefit from the positive productivity of that particular business. Again, a little bit more about generating income from real estate, purchases. One of the things to keep in mind, even with home ownership, and we do also offer a homeownership education webinar, Equity is the difference between the value and any balance owed on the property. The more you pay down your mortgage, the equity typically will increase in that home. Now, again, there's no guarantees in home ownership, but again, typically, buying property is a traditional way of wealth building. Again, I talked about rental properties where you can income is generated from rents and equity. Then again, that commercial property, again, income generated from rents and equity. So I wanted to quickly talk a little bit about the Department of Insurance and Financial Services. Every state has its own division in Michigan, it is the Department of Insurance and Financial Services, and these folks are super important. You can often find them on your state website, and their whole premise is to regulate, protect, and educate. They oversee regulation and licensing in individuals who work in the financial realm, such as brokers, dealers, investment advisors, and professionals in the financial world. They have oversight and licensing regulations and rules and conduct expectations of those particular professionals. They can review product offerings and they can provide investor education. Again, we're providing the number here for Michigan. I know a couple of folks are out of the state, but again, know that your state will offer an equivalent. If you ever have a question about maybe an individual or a product, definitely utilize that entity to assist in your research. So what if you don't have the benefit of someone providing an employer sponsored plan, and you have to kind of go this alone and looking for someone to help you when it comes to wealth building through investing? I'm going to provide you a great handout from the Consumer Financial Protection Bureau, what's called Know Your Financial Advisor. And it talks about things such as checking the person's background, doing reference check. Do understand that not all credentials are the same. There's a big difference between learning from someone, education or sales pitch. If someone's saying, you know what, you have to sign the dot line today, you're going to lose out on this. High pressure tactics, if they don't allow you time to research and think about something, it might be too good to be true. You want to make sure that you're empowered with good information. Again, we talked about your state authority that you can contact. We also talked a little bit about the Security and Exchange Commission and in some of the resources that I'm sending, another good one that I'm going to talk about. We already talked about FINRA is a great opportunity for calculators, but the FINRA broker check also allows you to investigate and research financial advisors and professionals to see if there have been any complaints or infractions against their license. So there are different entities where you can research, investigate to make sure that you minimize that opportunity of um being taken advantage of. Here's that slide that talks about working with the financial advisor. Is that seller licensed? Again, registered brokers are licensed through FINRA. They should be on that FINRA broker check. Is the investment register? We talked about making sure it's listed with the Security and Exchange Commission and if it's not, that's a good indication to walk away. Do you understand the investment? Is someone just telling you how much money you can make, but they're really not telling you what you're investing in? You want to make sure that that investment matches your goals and values. Where can you turn to help if you're not exactly sure again? Don't forget the SEC, FINRA, and again, your state regulatory body. So real quickly, and I'm checking the time because I could talk about this stuff for hours and I know that we don't have that much time, but I want to make sure that we're really looking at sort of zooming in on what are some steps we can take based on where we're at on that spectrum of our age. So let's say we're a younger adult, we're in our 20s. So what can we start thinking about to really be intentional about that notion of wealth building? Again, first step, begin contributions in an employer sponsored retirement plan and IRAs. Maybe your employer offers it during open enrollment, you chose not to participate. Great time now to investigate that and research it and learn more. And two, you might be pleasantly surprised that maybe your employer offers a matching program. So if you put a certain amount in, they might match you up to a certain amount. Again, that's free money. Also, too, start to allocate your investment assets in accordance with your risk tolerance because again, remember, as a younger person, you do have time on your side. So again, long term investment time frame can work to your benefit. In the literature, it says this is a time when you could take some risk. Again, it does come down to personal preference, but do know that when you have a longer time to save, if there has been a downturn, you have a longer time frame to recoup. Also, two, number three, super important. Also now is the time to think about minimizing debt on things such as credit cards and student loan debt. So let's continue on into our 30s and 40s. Let's say we're fortunate again to have an employer sponsored plan. Don't forget to maximum out those contributions in those plans. Don't forget the added benefit of looking into IRAs. Remember, we learned there's two : traditional and Roth. They have very different tax implications. And then, number two, allocate your investment assets in accordance with your risk tolerance and your long term investment time frame. And I think we're seeing a theme here, right, making sure we're looking at our time horizon. What is our goal and how long do we have to achieve that goal? Because remember, those will often dictate the best products for us to put our funds into. And now in our 30s and 40s, is a good time to start considering investing in real estate or other longer term assets. Said another way, 30s and 40s are often a time when people become homeowners. So that's kind of what that's talking about. So real quickly, we have a couple more slides, and then we're going to allow some space for Q&A. But one thing I did want to share is that, again, we are a HUD approved housing counseling agency. I mentioned we do have a homeownership education webinar. It's a four hour commitment. It's $25. We do offer scholarships. But what's great about the homeownership education webinar is not only do we cover the steps in the home buying process, we also talk about some pretty amazing down payment assistance programs that are available right now. So again, if you're interested, before we wrap up, I'll put our website back in the chat pod. But I wanted to talk real quickly about the Fair Housing Act because many people don't realize this offers protections not just for homeowners but for renters. It not only offers protections on the seven protected classes, which are race, color, national origin, religion, sex, familial status, and disability, but states and local communities can also add additional protections, and in our state, Michigan has added age and marital status. We want you to know if you feel as though you've been discriminated against, you can report that directly to HUD. You can reach out to any housing counseling agency to help you with that or your local Fair Housing Center. Now, real quickly, some references here. If you're taking screenshots, some of these will be sent, but you might want more information, so I wanted to always encourage further ongoing learning. Mymoney.gov is a great website. If you want to get some more insight into saving behaviors and strategies, investor.gov is amazing. I did a pretty good overview of different products and services, but investor.gov, that takes an even deeper dive. So if you feel like you know what? I learned something, but I want a little bit more, I highly encourage you visit that. I'm going to send you the Know Before You Owe fact sheet from the Consumer Financial Protection Bureau. Kathy put in the finra.org and the sec.gov emails into the chat. Oh, and she's also putting in a whole bunch more super great. I appreciate that. Again, these are just additional ways for you to get more information. And I'm going to quickly pause real quickly to ask if there are any questions I want you to think about them and why you're generating those. I want to turn things over real quickly to Kathy so she can talk about a super cool opportunity that's coming up in the near future. So think about questions you might have. We'll come back to those and Kathy, go ahead and take it over. Okay. Thank you. So if you are of the ages 13-19, we have a really cool contest going on right now where you can win money, well, not money, a gift $50 gift card. There's going to actually be ten winners, and it's a scavenger hunt and by attending today, you will do, it's one step closer to being able to answer some of the questions. On this, we use this Goose Chase app and this Goose Chase app is free to download. The cool thing is you'll get questions that you could maybe just text in an answer. There might be a question where you take a photo or a video. For instance, what is one of your savings goals? Take a video of something that represents it. You would take a photo and then upload it into the Goose Chase and we have young people 13-19 all over participating. It's fun to see some of the other people's responses. But like I said, the top winners are can win $50. This is sponsored through our Michigan Credit Union Foundation. It's just another fun way. It's an interactive way to learn about money, not just wealth building, all kinds of money topics. Many of you might have taken some of our classes in the past through Adulting 101 we always cover financial topics. It's one of our most popular actually. It's a really cool thing. I'm going to put in the chat a way to register and learn more about it. No, it just highlighted what I just copied earlier. So let me delete that and get a new one. But I did pop in the MyMoneyhealth.org website because I did talk about the spending plan webinar, I talked about the retirement myths and facts. We also have another one on tips to help protect your credit. We know we're putting a ton in that chat pod for you today, but we want to make sure that you have access to other great things. Great. Then these links will be sent in a follow up email after the after the webinar. Perfect. And then all the materials that Jenifer was referencing, so you'll have all of it to refer to. Great. I hope you'll join. It's going on throughout the whole month of April, you still have plenty of time for sure. To catch up, and start answering some of the missions. Cool. Thanks. So, again, we are coming at the top of the hour. I just wanted to quickly check in and see if there were any questions. I know that we covered a lot. A lot of good information. Again, as I mentioned before, it wasn't a one and done. We highly encourage you to do additional research and empower yourself with more information because wealth building is an ongoing journey, but we hope that you've enjoyed this time. I super appreciate getting to know many of you from all over Michigan and outside of our state. I hope that you walked away with some things to either contemplate or maybe some things to actually put into practice. And again, some of those handouts will hopefully help you start to think about some of those goals that you have. Well, you are more than welcome, Laura. If there are no other questions. Jenifer, if you can go to the next slide because that's a survey. Oh, yes, yes, yes, great, great, great. Thank you for inviting me. Yes, yes, yes. We would love to hear your input on today as a post survey. You can click on that or highlight the URL. Kathy is putting the link in the chat pod. But we appreciate this information because it helps us know what you liked and maybe where we can make improvements. If you haven't signed off yet and you're willing to do the post survey, we would be grateful. Then when you're done with that, unless there's anything else, you are free to go and enjoy the rest of your evening. But thank you so much for joining in today. It was a pleasure to meet you all. Yeah, we're still here if you have any additional questions. Okay. Thanks, TW. At least it's sunny here, but it's cold. It's not as warm as the sun, so it's chilly. Maybe the weather is nicer in other parts. Thanks, Raven. You're welcome. You're more than welcome. I hope it was helpful. Thank you. I'll go ahead and stop sharing, especially since the links in the chat. Thanks. Thanks, Laura, for doing the survey. I appreciate it. Thank you. Well, we hope everyone has a great evening. Stay warm. Yeah, exactly. You're in Michigan. It's a little chilly here. It is chilly here. Yeah, we'll offer it again. I promise we will. Laura, it's going to be recorded too, so some of the things that you might have missed. I'm going to actually stop the recording right now. But thank you, Jennifer, for joining us today and providing such useful and beneficial information for everybody. Okay.

Print

Print Email

Email