Understanding the farm's financial health - Part two

Part 2: Basic components to a successful business.

Digging deeper into your farm’s financial health to help you get out of a hole. Michigan State University Extension Farm Management Educators want to add depth to your understanding.

In the last part of our series, we discussed the value of understanding the farm’s financial health and compared it to the value found in soil sampling. Let’s now turn our focus into how we go about actually testing our farm’s financial health to help us make better, more effective decisions.

Like a soil test, we have to collect our core samples from which we will analyze our farm’s information. The core samples of a “financial” soil sample are found in gathering or creating three important documents. These are a balance sheet, an income statement, and a cash flow statement.

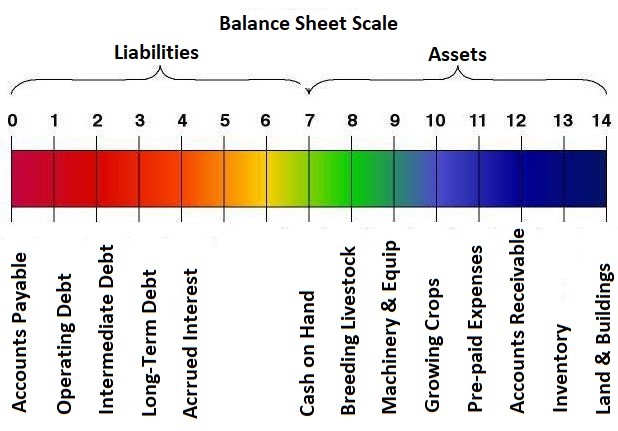

The balance sheet is a snapshot in time of a business’ assets, liabilities, and net worth (i.e. owner equity). It tells us whether the farm’s cash flow is enough to cover debts within the normal course of the year or if the farm were forced to liquidate; giving us a snapshot of what our financial situation is at the moment. It focuses on two main concepts; liquidity and solvency.

Liquidity is the ability of the business to meet financial debts as they come due. It measures this ability by looking at three ratios: current ratio, working capital, and working capital to gross incomes. These ratios can be found in detail under the Farm Financial Ratio series by Adam Kantrovich on the MSU News webpage.

In thinking about liquidity, let’s go back to our soil test example. This would be similar to knowing if we had enough available nutrients to meet the plant’s needs and reach our yield goal. Do we have enough? Do we need to add more? How should we begin planning to add them?

.jpg)

.jpg)

Solvency is the ability of your farm to pay all of its debts as if it were sold tomorrow. This is important in evaluating the financial risk and borrowing ability of the business. The ratios it focuses on are debt-to-asset, equity-to-asset, and debt-to-equity.

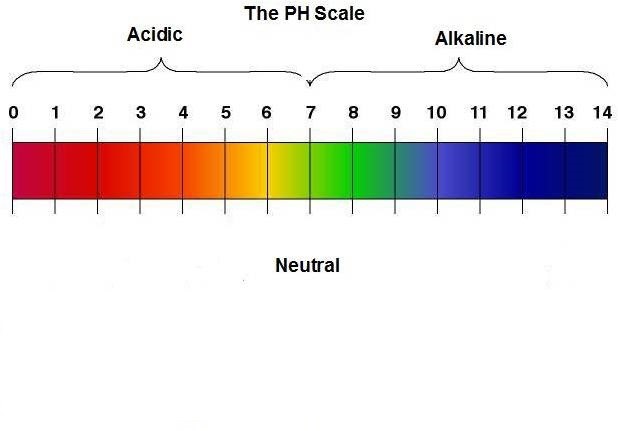

What would solvency be on a soil test? The pH levels tell us what nutrients are free or unbound by the soil and available for the plant to use. How many of our assets are tied up by debt? Do we have more to borrow against? If we had to sell today, could we pay off all our debts?

The next important document is the income statement. It measures profitability and how the business got to its current financial situation over a period of time. Profitability is the difference between the value of goods produced and the cost of the materials used to make them. This could be used to cover family living, taxes, or reinvested into the business, which increases your farm’s net worth.

It focuses on a number of different ratios, including net farm income, rate of return on assets, rate of return on equity, operating profit margin, and earnings before interest, taxes, depreciation, and amortization (EBITDA). Each of these measure the farm’s profit that is returned from investments in capital, land, labor, and even management.

How would we think about profitability with a soil test? Did we reach our goal with what we put towards it? What did we get back for our efforts in the growing season? After we’ve paid for everything, is there anything left over that could be used for other things or even used next year?

Take a moment to get out your farm’s latest balance sheet and income statement. Where is its financial health related to liquidity, solvency, and profitability? Are the assets you have on-hand enough to pay the bills due at the end of the year? How many of these assets are truly free for the farm to use? What money was left over to put towards other investments the farm wants to make?

In the next part of this series, we’ll talk about how the cash flow statement impacts the answers to these questions. We’ll also discuss how all three financial documents function together to help you understand as well as make use of your farm’s financial health.

This is the second of four short articles about farm financial health. Read the other parts by clicking on the links below:

Basic components to a successful business part one.

Basic components to a successful business part three.

Basic components to a successful business part four.

Print

Print Email

Email