Will an improved PLC program pay more often?

Testing PLC updates against historical prices and looking forward to future support.

Recent legislation has included updates to several Farm Bill Commodity Programs. In particular, the Price Loss Coverage (PLC) program had a significant number of changes made to improve support benefits. Many of the reports that analyze benefits have focused on the increase of potential payment amounts. However, PLC has historically struggled to trigger any actual payments for corn and soybean growers. That begs the question: Do PLC updates mean producers will see actual payments more often?

PLC changes explained

PLC payments are based on a market year average price (MYA). To trigger a PLC payment, the MYA price must fall below a statutory reference price. The difference becomes PLC’s payment rate. In the 2018 Farm Bill, an escalator clause was introduced to use 85% of an Olympic average in place of the statutory reference price. An Olympic average removes the highest and lowest values from a dataset. The Olympic average for the escalator clause skips the previous year and uses the next five years’ worth of historical prices for its dataset. For example, to calculate the 2025 Olympic average, the 2024 production year would be skipped. An Olympic average would then be calculated using 2019-2023. The escalator clause is then used in place of the statutory reference price if it is higher. Referred to as the effective reference price, it is then capped at 115% of the statutory reference price.

Recent changes made to PLC will be handled in two phases. Phase one begins in 2025 with statutory reference prices for corn increased from $3.70 to $4.10 and soybeans from $8.40 to $10.00. The escalator clause also increased from 85% of an Olympic average to 88%. Phase two begins in 2031 with the statutory reference price increased by 1.005 each year. Also beginning in 2031, the effective reference price cap will be reduced from 115% to 113%.

Historically, corn and soybean producers have not received a lot of support from the PLC program. The lack of support was notable during the 2018 Farm Bill period or 2019-2024 production seasons. In particular, from 2022 through 2024, corn lost $2.00 per bushel and soybeans lost over $4.00 per bushel. The loss of value has significantly impacted short and long-term financial stability for many farms. During this period, PLC offered no support to producers. The fundamental lack of support led to calls for program reforms, many of which focused on the need for aid during these types of market conditions.

Is PLC really improved?

To determine if PLC protects producers against similar market conditions seen in the 2018 Farm Bill period, a comparison using data from those years is helpful. For illustrative purposes, only phase two of PLC updates will be reviewed as the outcomes of phase one are identical in the figures shown (Figures 1 and 2). Phase two updates include the yearly increases to statutory reference prices and adjusted 113% effective reference price cap.

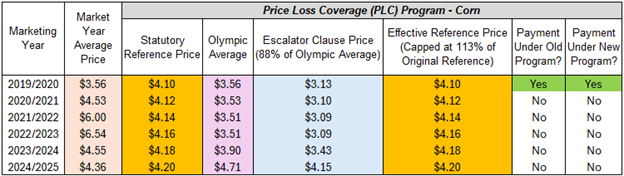

Figure 1. Price Loss Coverage (PLC) projected payments for corn

Figure 1 outlines whether payments would be made under phase two guidelines for corn growers. Statutory reference prices start at $4.10 and increase 1.005 each year. The effective reference price is capped at 113% of the statutory reference price each year.

For corn, the production year for 2019 would be the sole recipient of a support payment under the new guidelines. However, support was already provided under the original program during 2019, shown in Figure 1 as “payments under old program?” Other than a higher payment rate for 2019, no additional help would be offered. Subsequent years still receive no payment support.

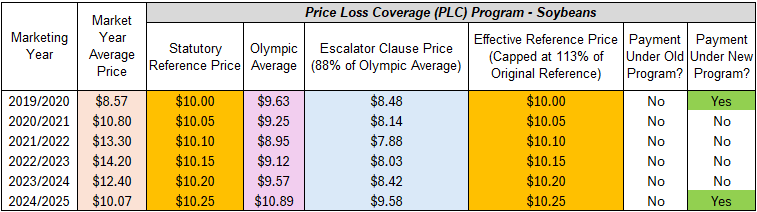

Figure 2. Price Loss Coverage (PLC) projected payments for soybeans

Figure 2 outlines whether payments would be made under phase two guidelines for soybean growers. Statutory reference prices start at $10.00 and increase by 1.005 each year. The effective reference price is capped at 113% of the statutory reference price each year.

There is improvement for soybeans from the program updates. A support payment would be made in both 2019 and 2024, whereas no payments were originally available. However, the 2024 payment rate is marginal considering the market conditions experienced from 2022-2024. Producers lost $4.13 per bushel between 2022-2024 ($14.20 - $10.07 = $4.13). The payment rate for 2024 would be $0.18 per bushel ($10.25 - $10.07 = $0.18). Because no payments would be received between 2020-2023, only the $0.18 support payment would be made against the $4.13 per bushel loss. Note: the PLC payment rate is only paid on 85% of base acres, making the final rate effectively $0.15 per bushel ($0.18 x 85%).

In reviewing Figures 1 and 2, the most notable difference is in the 2019 payments. Corn received a payment in 2019 under the 2018 Farm Bill. However, soybeans did not. If either phase one or phase two of the updated PLC guidelines were in place, soybeans would have received a $1.43 per bushel payment in that year. Unfortunately, the analysis also highlights that updated guidelines would still not provide support to producers from market conditions in 2022-2024. Despite the changes, PLC remains unable to timely adjust support based on dramatically falling prices.

Looking forward to future PLC payments

PLC relies on statutory reference prices to provide support based on current market conditions. If prices remain at or just above reference prices, no support is expected. Based on USDA price projections, reference prices are unlikely to trigger payments over most of the next 10-year period (Figures 3 and 4).

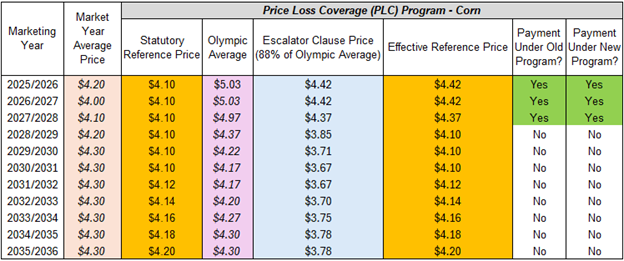

Nevertheless, projections are that Olympic averages from 2019-2025 will lead to higher effective reference prices from 2025-2027. This means that the market conditions from 2022-2024 do factor into the calculation for PLC support payments made in the future. Specifically, the statutory reference prices (column 3, Figure 3) are largely expected to be below the projected MYA prices for 2025-2027. The net result would yield no support payments since payment triggers require the statutory reference price to be higher than the MYA price. However, market conditions from 2022-2024 create a high enough Olympic average to increase the 2025-2027 effective reference prices (column 6, Figure 3) above projected MYA prices. The escalator clause takes effect and generates support payments in those years. Note: For 2026, payment support is projected to trigger for corn from the statutory reference price. Nevertheless, corn growers also benefit from the escalator clause in that year as it generates a higher payment ($4.10 - $4.00 = $0.10 vs. $4.42 - $4.00 = $0.42).

Figure 3. Forecasts of Price Loss Coverage (PLC) payments for corn

Figure 3 shows that payments for corn growers are estimated to be made based primarily on the escalator clause from 2025 through 2027. However, no payments are projected by USDA from 2028 through 2035, despite the yearly 1.005 increase to reference prices.

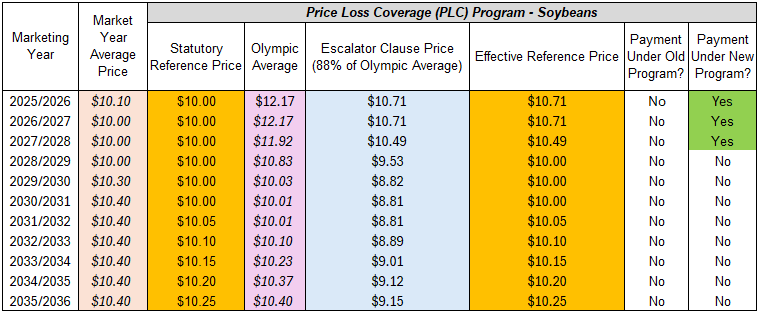

Figure 4. Forecasts of Price Loss Coverage (PLC) payments for soybeans

There is a slight improvement to the frequency of payments for soybeans based on the PLC program updates. Figure 4 outlines that payments for soybean growers are also estimated to be made based primarily on the escalator clause from 2025 through 2027. No payments are also projected from 2028 through 2035, despite the yearly 1.005 increase to statutory reference prices. However, unlike corn, soybeans were not projected to receive any payments from 2025-2035 under the prior PLC program.

Note: For both Figures 3 and 4, the 2025/2026 market-year average (MYA) price is based on the July USDA WASDE report. The report considers historical trends as well as current and projected market trends. The remaining MYA prices used are estimates from USDA Economic Research Service (ERS) Agricultural Baseline Projections. Updated annually, the projections provide an “if no changes occur” type of price forecast for the next 10 years.

Like most risk management programs, support is seldom needed when prices are stable or higher than expected. The true test of a support program is how it responds when producers need it most. Price support programs are needed to protect against extreme market conditions. Analysis indicates that updates to PLC do not account for rapidly falling prices such as those seen from 2022-2024.

On the other hand, the improvements made to PLC statutory reference prices should generate higher payment rates when support is triggered. However, statutory reference prices by themselves are not expected to increase the frequency of how often producers receive payments.

The real safety net within the PLC program is its escalator clause. Unfortunately, one of the limitations of the escalator clause is the delayed reaction to volatile market conditions. PLC eventually will consider those conditions, but support may not arrive for several years after they occur.

Producers are encouraged to use the 2025 season as a potential indicator of future program support. Regardless of initially choosing between PLC and ARC-CO, producers will automatically receive the better payment rate between the programs. ARC-CO received its own improvements to program support, which includes yields and prices. Receiving the better payment between programs in 2025 provides an opportunity to compare each program directly. That comparison may be helpful for future program sign-up decisions. Producers will have to choose between the two programs again in 2026.

Print

Print Email

Email