Prosper

|

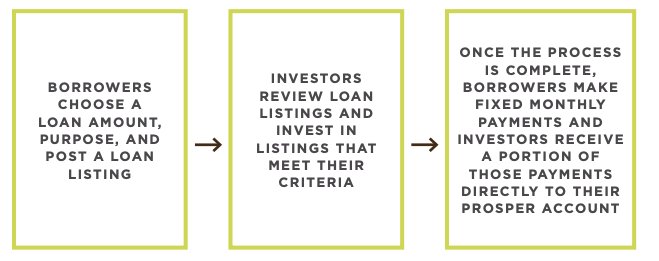

Click the button above for more information. How it WorksProsper is a peer-to-peer lending entity— an alternative to traditional loans and investing options.

Funding Focuses OnLoan types: debt consolidation, home improvement, personal or business use, auto & vehicle, short term & bridge, energy efficiency initiative loans, and more. Funding Limit$50,000 QualificationsLoan options are based on applicants’ personal financial history. Service fees apply. Financing Geographic AreaUnited States Last updated 2/20/25 |

Print

Print Email

Email